Should You Be Adding Affle (India) (NSE:AFFLE) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Affle (India) (NSE:AFFLE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Affle (India) with the means to add long-term value to shareholders.

View our latest analysis for Affle (India)

Affle (India)'s Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Affle (India)'s shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 51%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

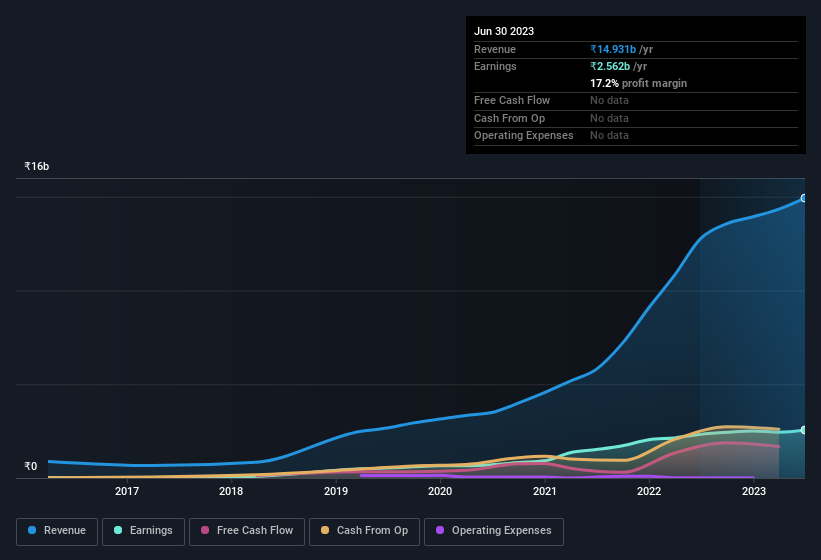

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Affle (India) maintained stable EBIT margins over the last year, all while growing revenue 17% to ₹15b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Affle (India)'s future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Affle (India) Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Affle (India) insiders spent ₹1.7m on stock; good news for shareholders. While this isn't much, we also note an absence of sales.

Recent insider purchases of Affle (India) stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations between ₹83b and ₹265b, like Affle (India), the median CEO pay is around ₹44m.

The CEO of Affle (India) was paid just ₹253k in total compensation for the year ending March 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Affle (India) Worth Keeping An Eye On?

Affle (India)'s earnings have taken off in quite an impressive fashion. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests Affle (India) may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. Of course, profit growth is one thing but it's even better if Affle (India) is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Affle (India), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AFFLE

Affle 3i

Provides mobile advertisement services through information technology and software development services for mobiles in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives