- India

- /

- Professional Services

- /

- NSEI:RITES

Indian Stocks That May Be Priced Below Intrinsic Value In October 2024

Reviewed by Simply Wall St

As the Indian stock market navigates the potential impacts of the 2024 US presidential election, investors are closely watching how changes in trade policies, foreign direct investment, and interest rates might influence market dynamics. In this environment of global uncertainty and economic interdependence, identifying stocks that may be priced below their intrinsic value becomes crucial for investors looking to capitalize on potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sudarshan Chemical Industries (BSE:506655) | ₹969.50 | ₹1832.12 | 47.1% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1191.70 | ₹2149.50 | 44.6% |

| RITES (NSEI:RITES) | ₹292.85 | ₹518.21 | 43.5% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹391.40 | ₹762.32 | 48.7% |

| Vedanta (NSEI:VEDL) | ₹463.00 | ₹898.73 | 48.5% |

| Patel Engineering (BSE:531120) | ₹50.58 | ₹90.43 | 44.1% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹52.98 | ₹89.61 | 40.9% |

| Tarsons Products (NSEI:TARSONS) | ₹400.75 | ₹707.28 | 43.3% |

| Manorama Industries (BSE:541974) | ₹971.35 | ₹1665.51 | 41.7% |

| Strides Pharma Science (NSEI:STAR) | ₹1560.25 | ₹2704.30 | 42.3% |

We're going to check out a few of the best picks from our screener tool.

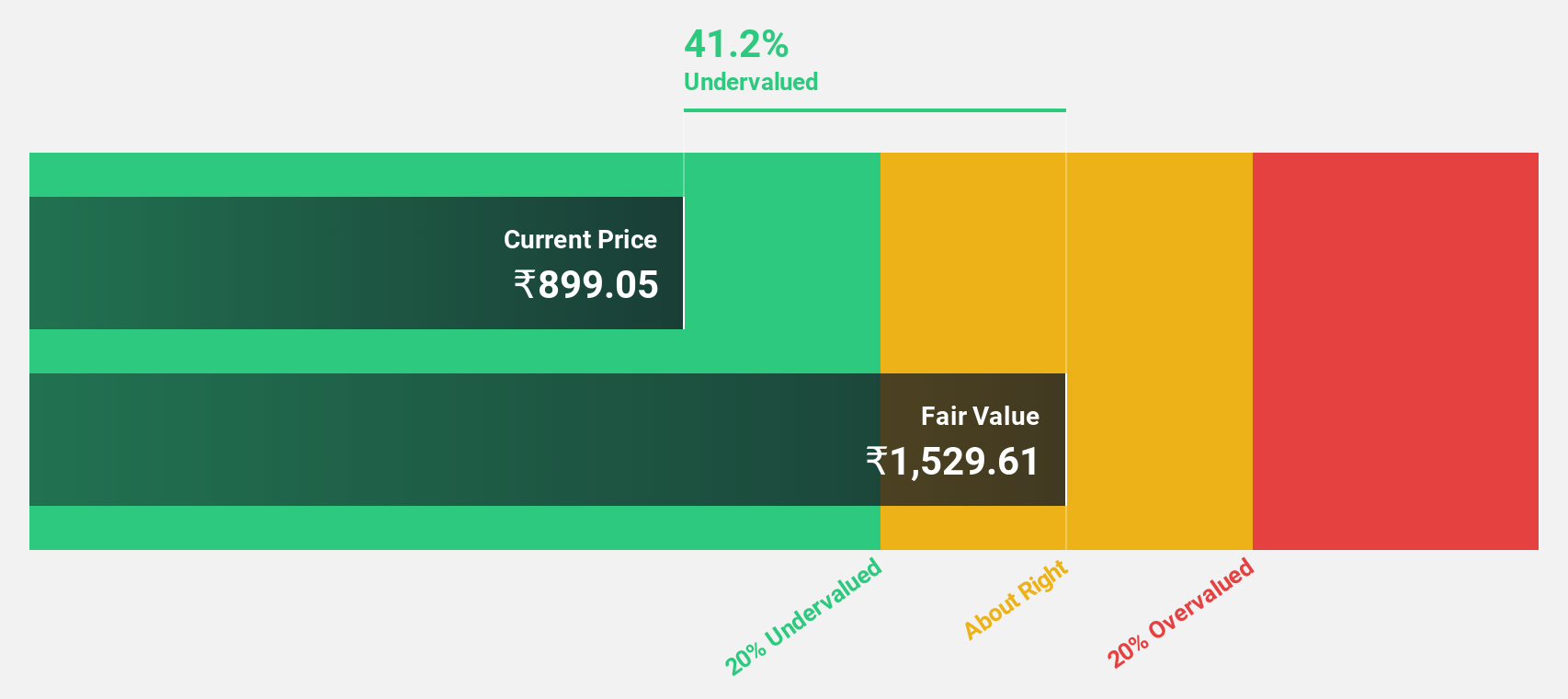

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited is engaged in the steel, mining, and infrastructure sectors both in India and internationally, with a market capitalization of ₹933.84 billion.

Operations: The company's revenue primarily comes from manufacturing steel products, amounting to ₹510.56 billion.

Estimated Discount To Fair Value: 25.6%

Jindal Steel & Power is trading at ₹915.45, notably below its estimated fair value of ₹1229.67, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 26.1% annually, surpassing the Indian market average of 17.5%. Recent strategic alliances for green hydrogen integration highlight a commitment to sustainable practices, potentially enhancing long-term profitability and positioning Jindal Steel as a leader in decarbonization within India's steel industry.

- In light of our recent growth report, it seems possible that Jindal Steel & Power's financial performance will exceed current levels.

- Navigate through the intricacies of Jindal Steel & Power with our comprehensive financial health report here.

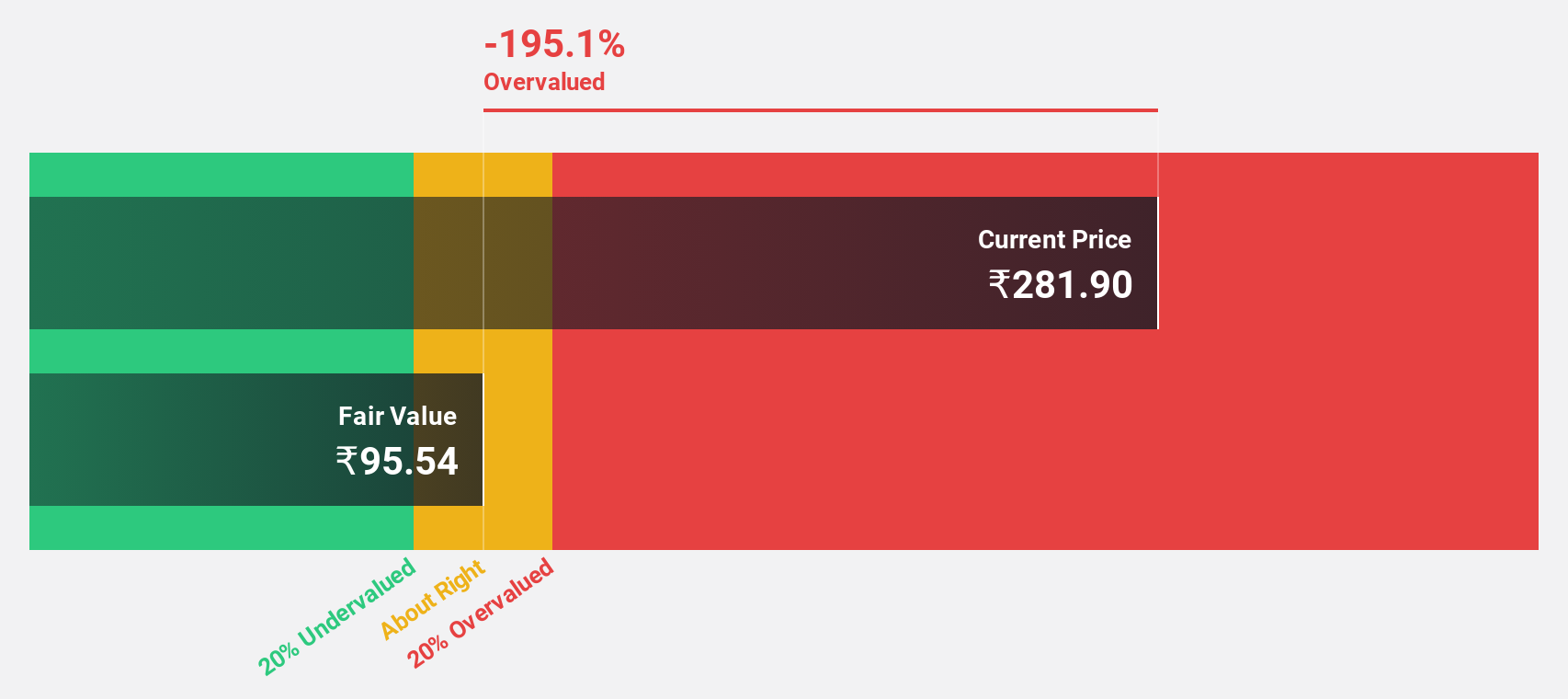

RITES (NSEI:RITES)

Overview: RITES Limited, along with its subsidiaries, offers design, engineering consultancy, and project management services across sectors such as railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways and renewable energy; it has a market cap of ₹140.74 billion.

Operations: The company's revenue segments include Export Sale (₹699 million), Power Generation (₹177.80 million), Leasing - Domestic (₹1.41 billion), Consultancy - Abroad (₹766.10 million), Consultancy - Domestic (₹11.79 billion), and Turnkey Construction Projects - Domestic (₹9.10 billion).

Estimated Discount To Fair Value: 43.5%

RITES is trading at ₹292.85, significantly below its estimated fair value of ₹518.21, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow at 23.5% annually, outpacing the Indian market average growth rate of 17.5%. Recent developments include a strategic partnership with Etihad Rail and several new turnkey projects in India, which could enhance revenue streams and operational efficiency despite a recent resignation impacting its audit committee leadership.

- Insights from our recent growth report point to a promising forecast for RITES' business outlook.

- Delve into the full analysis health report here for a deeper understanding of RITES.

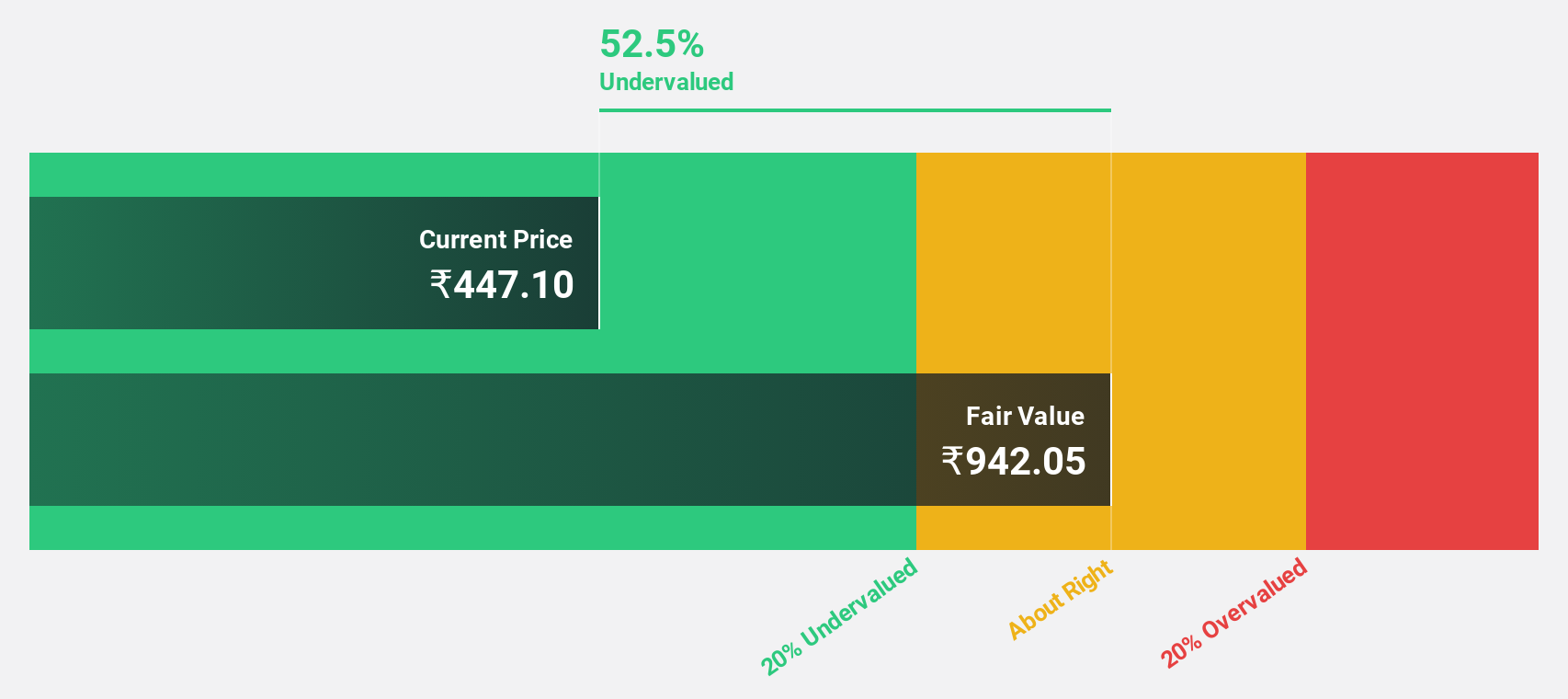

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited is a diversified natural resources company engaged in the exploration, extraction, and processing of minerals, oil, and gas across India and various international markets with a market cap of ₹1.81 trillion.

Operations: Vedanta Limited generates revenue from several key segments, including Aluminium (₹499.81 billion), Copper (₹197.31 billion), Oil and Gas (₹179.05 billion), Iron Ore (₹83.51 billion), Power (₹62.54 billion), and Zinc - International (₹32.06 billion).

Estimated Discount To Fair Value: 48.5%

Vedanta is trading at ₹463, considerably below its estimated fair value of ₹898.73, highlighting potential undervaluation based on cash flows. Despite a high debt level and recent regulatory challenges, the company’s earnings are projected to grow 40% annually over the next three years, surpassing the Indian market average. The anticipated demerger into separate entities could simplify its corporate structure and provide direct investment opportunities in focused sectors like aluminium and oil.

- Our expertly prepared growth report on Vedanta implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Vedanta with our detailed financial health report.

Key Takeaways

- Take a closer look at our Undervalued Indian Stocks Based On Cash Flows list of 30 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RITES

RITES

Provides design, engineering consultancy, and project management services in the field of railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways, and renewable energy.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives