- India

- /

- Metals and Mining

- /

- NSEI:USHAMART

There's No Escaping Usha Martin Limited's (NSE:USHAMART) Muted Earnings Despite A 28% Share Price Rise

Usha Martin Limited (NSE:USHAMART) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 64%.

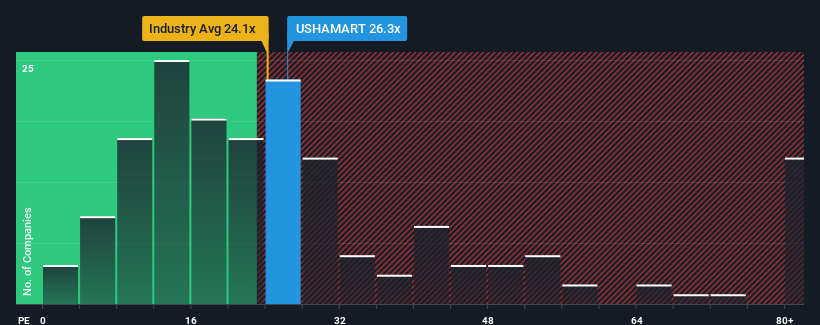

Although its price has surged higher, Usha Martin's price-to-earnings (or "P/E") ratio of 26.3x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 31x and even P/E's above 58x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, Usha Martin has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Usha Martin

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Usha Martin would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. The strong recent performance means it was also able to grow EPS by 303% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 19% over the next year. Meanwhile, the rest of the market is forecast to expand by 24%, which is noticeably more attractive.

In light of this, it's understandable that Usha Martin's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Usha Martin's P/E

Despite Usha Martin's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Usha Martin maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Usha Martin that you need to be mindful of.

Of course, you might also be able to find a better stock than Usha Martin. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:USHAMART

Usha Martin

Manufactures and sells steel wires, strands, wire ropes, and cord related accessories in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives