- India

- /

- Basic Materials

- /

- NSEI:ULTRACEMCO

UltraTech Cement (NSE:ULTRACEMCO) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that UltraTech Cement Limited (NSE:ULTRACEMCO) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for UltraTech Cement

What Is UltraTech Cement's Net Debt?

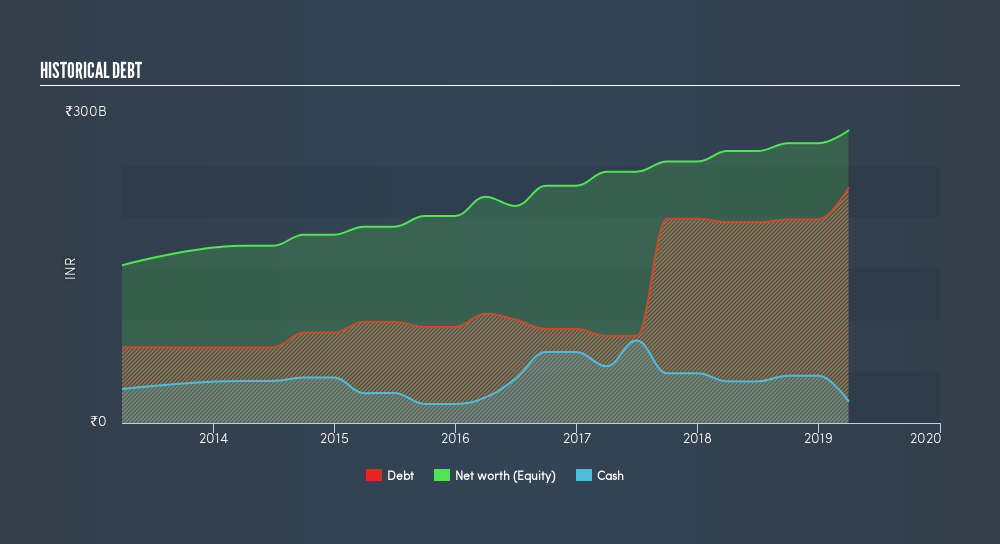

As you can see below, at the end of March 2019, UltraTech Cement had ₹228.2b of debt, up from ₹194.8b a year ago. Click the image for more detail. However, it does have ₹21.3b in cash offsetting this, leading to net debt of about ₹206.9b.

How Strong Is UltraTech Cement's Balance Sheet?

We can see from the most recent balance sheet that UltraTech Cement had liabilities of ₹128.6b falling due within a year, and liabilities of ₹232.8b due beyond that. On the other hand, it had cash of ₹21.3b and ₹35.5b worth of receivables due within a year. So it has liabilities totalling ₹304.5b more than its cash and near-term receivables, combined.

UltraTech Cement has a very large market capitalization of ₹1.24t, so it could very likely ameliorate its balance sheet if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Either way, since UltraTech Cement does have more debt than cash, it's worth keeping an eye on its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

UltraTech Cement's debt is only 3.05 times its EBITDA, and its EBIT cover its interest expense 3.25 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The good news is that UltraTech Cement improved its EBIT by 7.9% over the last twelve years, thus gradually reducing its debt levels relative to its earnings. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if UltraTech Cement can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, UltraTech Cement recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

On our analysis UltraTech Cement's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its interest cover makes us a little nervous about its debt. Considering this range of data points, we think UltraTech Cement is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Over time, share prices tend to follow earnings per share, so if you're interested in UltraTech Cement, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ULTRACEMCO

UltraTech Cement

Primarily engages in the manufacture and sale of clinker, cement, and related products in India.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives