- India

- /

- Basic Materials

- /

- NSEI:ULTRACEMCO

UltraTech Cement (NSE:ULTRACEMCO) Is Paying Out A Larger Dividend Than Last Year

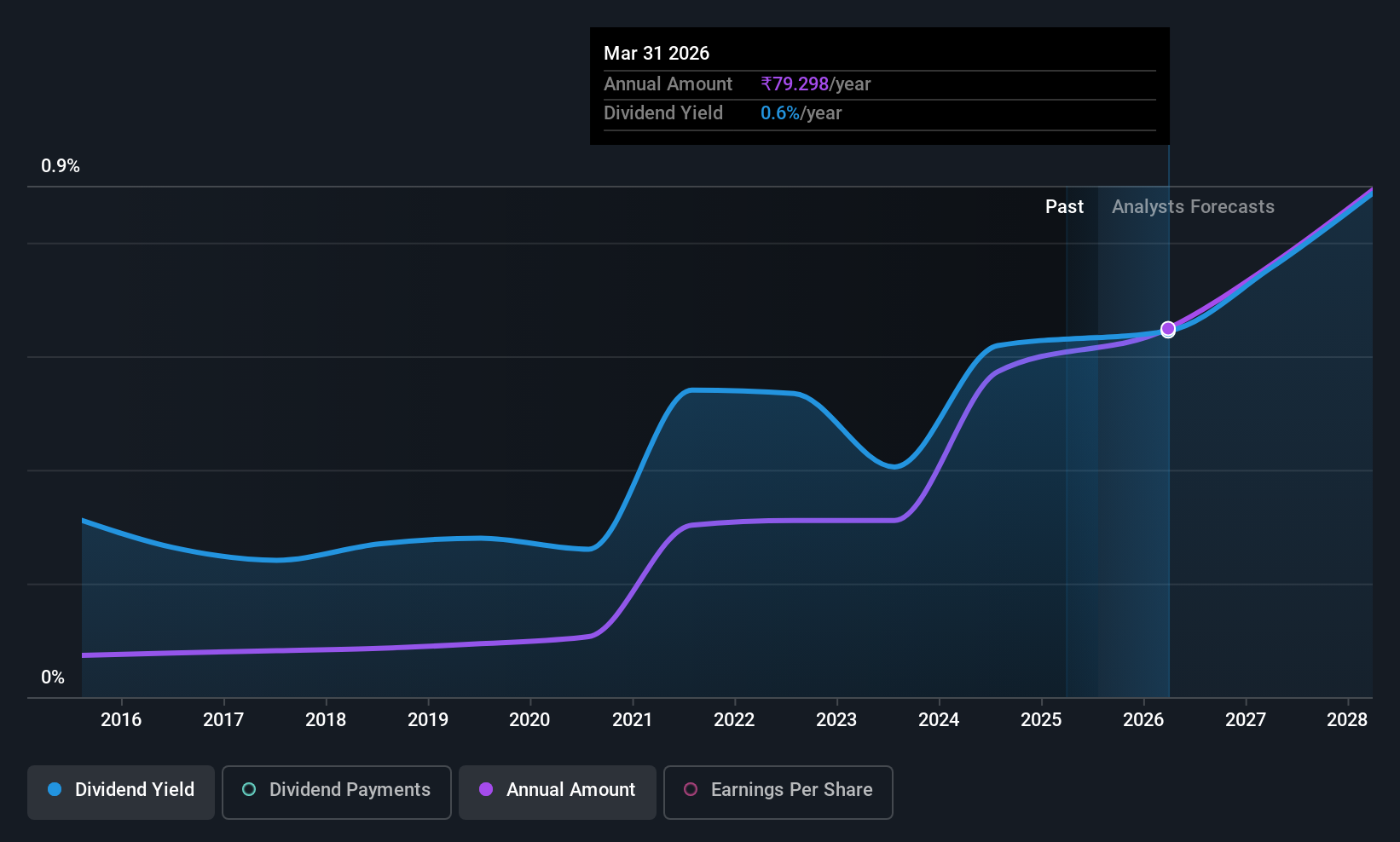

UltraTech Cement Limited (NSE:ULTRACEMCO) will increase its dividend from last year's comparable payment on the 18th of September to ₹77.50. This takes the dividend yield to 0.6%, which shareholders will be pleased with.

UltraTech Cement's Payment Could Potentially Have Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, UltraTech Cement was paying a whopping 148% as a dividend, but this only made up 38% of its overall earnings. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

The next year is set to see EPS grow by 95.9%. If the dividend continues on this path, the payout ratio could be 21% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for UltraTech Cement

UltraTech Cement Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2015, the annual payment back then was ₹9.00, compared to the most recent full-year payment of ₹77.50. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. Earnings per share has been crawling upwards at 4.5% per year. If UltraTech Cement is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

Our Thoughts On UltraTech Cement's Dividend

In summary, while it's always good to see the dividend being raised, we don't think UltraTech Cement's payments are rock solid. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for UltraTech Cement that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ULTRACEMCO

UltraTech Cement

Engages in the manufacture and sale of clinker, cement, ready mix concrete, and related products in India, the United Arab Emirates, Bahrain, and Sri Lanka.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.