- India

- /

- Paper and Forestry Products

- /

- NSEI:TNPL

Tamil Nadu Newsprint and Papers (NSE:TNPL) Will Pay A Smaller Dividend Than Last Year

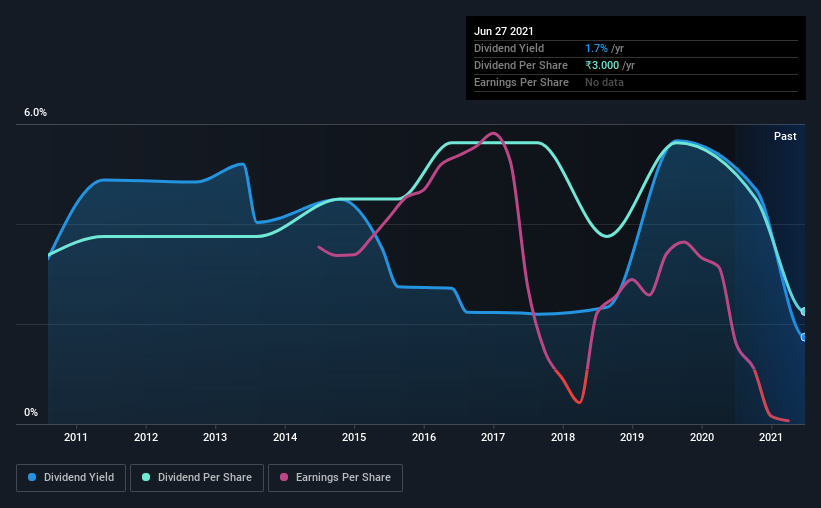

Tamil Nadu Newsprint and Papers Limited's (NSE:TNPL) dividend is being reduced to ₹3.00 on the 23rd of October. However, the dividend yield of 1.7% is still a decent boost to shareholder returns.

See our latest analysis for Tamil Nadu Newsprint and Papers

Tamil Nadu Newsprint and Papers' Distributions May Be Difficult To Sustain

If the payments aren't sustainable, a high yield for a few years won't matter that much. Despite not generating a profit, Tamil Nadu Newsprint and Papers is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Looking forward, earnings per share could 39.3% over the next year if the trend of the last few years can't be broken. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was ₹4.50 in 2011, and the most recent fiscal year payment was ₹3.00. Doing the maths, this is a decline of about 4.0% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Tamil Nadu Newsprint and Papers' EPS has fallen by approximately 39% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Tamil Nadu Newsprint and Papers' Dividend Doesn't Look Great

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Tamil Nadu Newsprint and Papers has 3 warning signs (and 2 which are a bit concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Tamil Nadu Newsprint and Papers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tamil Nadu Newsprint and Papers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TNPL

Tamil Nadu Newsprint and Papers

Manufactures and markets paper and paperboards in India and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026