- India

- /

- Metals and Mining

- /

- NSEI:TEMBO

Does Tembo Global Industries (NSE:TEMBO) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tembo Global Industries (NSE:TEMBO). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Tembo Global Industries

How Quickly Is Tembo Global Industries Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Tembo Global Industries' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 50%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

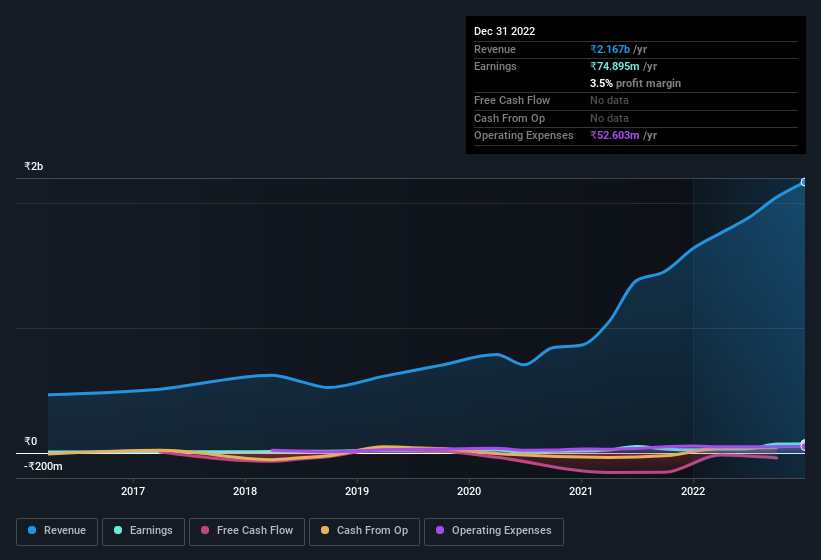

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Tembo Global Industries maintained stable EBIT margins over the last year, all while growing revenue 33% to ₹2.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Tembo Global Industries is no giant, with a market capitalisation of ₹2.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Tembo Global Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Tembo Global Industries will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ₹1.5b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Tembo Global Industries Worth Keeping An Eye On?

Tembo Global Industries' earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Tembo Global Industries for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Tembo Global Industries (1 is concerning) you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tembo Global Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEMBO

Tembo Global Industries

Engages in jobbing, machining, manufacturing, and fabrication of engineering goods, steel products, nuts, bolts, clamps, and hangers in India and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives