- India

- /

- Metals and Mining

- /

- NSEI:TATASTEEL

Tata Steel (NSE:TATASTEEL) Has Some Way To Go To Become A Multi-Bagger

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Having said that, from a first glance at Tata Steel (NSE:TATASTEEL) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Tata Steel, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.082 = ₹156b ÷ (₹2.8t - ₹919b) (Based on the trailing twelve months to September 2024).

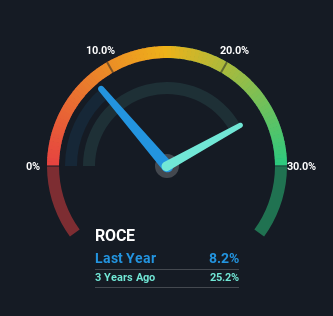

So, Tata Steel has an ROCE of 8.2%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 14%.

Check out our latest analysis for Tata Steel

Above you can see how the current ROCE for Tata Steel compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Tata Steel .

So How Is Tata Steel's ROCE Trending?

There hasn't been much to report for Tata Steel's returns and its level of capital employed because both metrics have been steady for the past five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if Tata Steel doesn't end up being a multi-bagger in a few years time. This probably explains why Tata Steel is paying out 30% of its income to shareholders in the form of dividends. Unless businesses have highly compelling growth opportunities, they'll typically return some money to shareholders.

In Conclusion...

In summary, Tata Steel isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Yet to long term shareholders the stock has gifted them an incredible 237% return in the last five years, so the market appears to be rosy about its future. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

One more thing to note, we've identified 2 warning signs with Tata Steel and understanding them should be part of your investment process.

While Tata Steel isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Tata Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TATASTEEL

Tata Steel

Engages in the manufacture and distribution of steel products in India and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026