- India

- /

- Metals and Mining

- /

- NSEI:SUNFLAG

Sunflag Iron and Steel Company Limited's (NSE:SUNFLAG) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Sunflag Iron and Steel Company Limited (NSE:SUNFLAG) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.3% over the last twelve months.

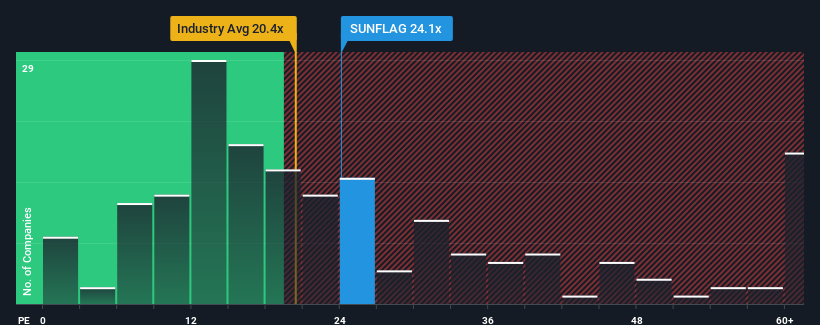

Even after such a large drop in price, it's still not a stretch to say that Sunflag Iron and Steel's price-to-earnings (or "P/E") ratio of 24.1x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 26x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The earnings growth achieved at Sunflag Iron and Steel over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Sunflag Iron and Steel

How Is Sunflag Iron and Steel's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sunflag Iron and Steel's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. However, this wasn't enough as the latest three year period has seen a very unpleasant 37% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Sunflag Iron and Steel's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

With its share price falling into a hole, the P/E for Sunflag Iron and Steel looks quite average now. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sunflag Iron and Steel currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sunflag Iron and Steel you should know about.

You might be able to find a better investment than Sunflag Iron and Steel. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUNFLAG

Sunflag Iron and Steel

Manufactures and sells steel rolled products in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives