- India

- /

- Metals and Mining

- /

- NSEI:STEELXIND

Steel Exchange India (NSE:STEELXIND) shareholders are still up 914% over 3 years despite pulling back 11% in the past week

It's been a soft week for Steel Exchange India Limited (NSE:STEELXIND) shares, which are down 11%. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 914%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The only way to form a view of whether the current price is justified is to consider the merits of the business itself. Anyone who held for that rewarding ride would probably be keen to talk about it.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

Check out our latest analysis for Steel Exchange India

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Steel Exchange India became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

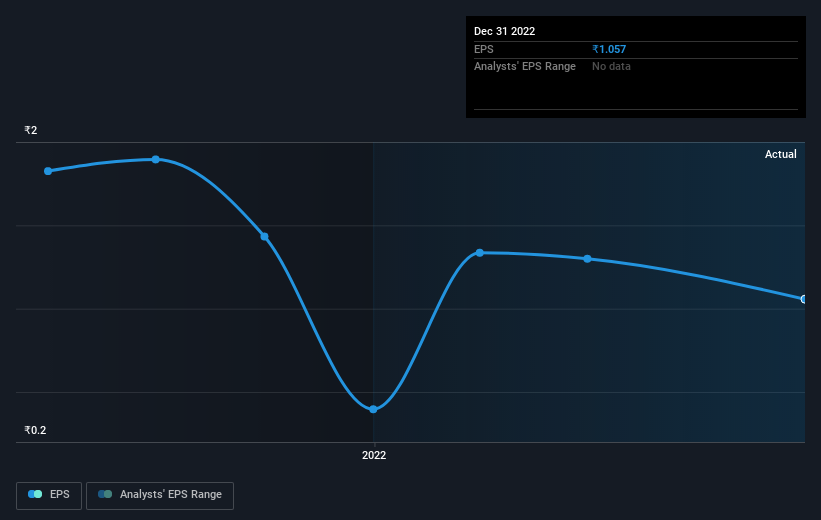

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market lost about 1.0% in the twelve months, Steel Exchange India shareholders did even worse, losing 40%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 42% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Steel Exchange India better, we need to consider many other factors. For instance, we've identified 3 warning signs for Steel Exchange India (1 is significant) that you should be aware of.

Of course Steel Exchange India may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade Steel Exchange India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:STEELXIND

Steel Exchange India

Engages in the manufacture and sale of steel products under the SIMHADRI TMT brand name in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives