- India

- /

- Metals and Mining

- /

- NSEI:STEELXIND

Here's Why Steel Exchange India (NSE:STEELXIND) Has A Meaningful Debt Burden

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Steel Exchange India Limited (NSE:STEELXIND) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Steel Exchange India

How Much Debt Does Steel Exchange India Carry?

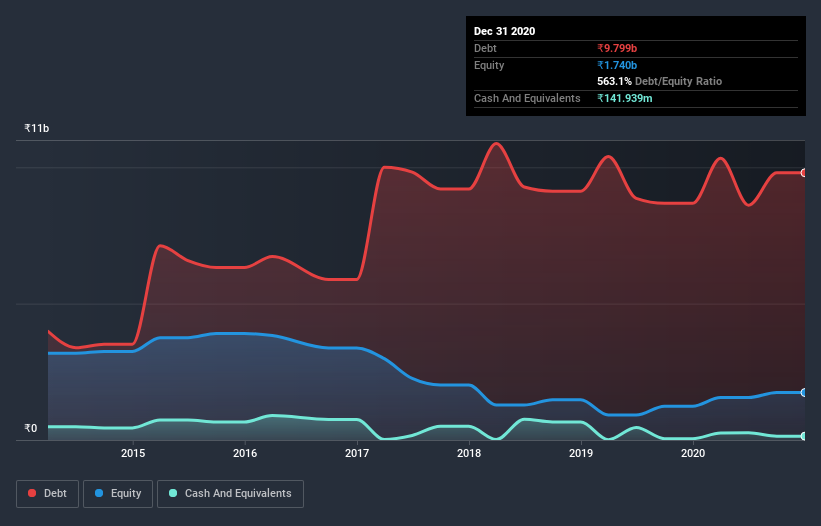

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Steel Exchange India had ₹9.80b of debt, an increase on ₹8.68b, over one year. And it doesn't have much cash, so its net debt is about the same.

A Look At Steel Exchange India's Liabilities

Zooming in on the latest balance sheet data, we can see that Steel Exchange India had liabilities of ₹10.4b due within 12 months and liabilities of ₹1.32b due beyond that. Offsetting this, it had ₹141.9m in cash and ₹233.3m in receivables that were due within 12 months. So it has liabilities totalling ₹11.4b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₹4.10b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Steel Exchange India would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Steel Exchange India's debt to EBITDA ratio of 9.9 suggests a heavy debt load, its interest coverage of 7.9 implies it services that debt with ease. Overall we'd say it seems likely the company is carrying a fairly heavy swag of debt. Notably, Steel Exchange India made a loss at the EBIT level, last year, but improved that to positive EBIT of ₹718m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Steel Exchange India's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Steel Exchange India actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

To be frank both Steel Exchange India's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Steel Exchange India's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Steel Exchange India (1 is potentially serious!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Steel Exchange India, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:STEELXIND

Steel Exchange India

Engages in the manufacture and sale of steel products under the SIMHADRI TMT brand name in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives