Investors Appear Satisfied With Solar Industries India Limited's (NSE:SOLARINDS) Prospects As Shares Rocket 40%

The Solar Industries India Limited (NSE:SOLARINDS) share price has done very well over the last month, posting an excellent gain of 40%. The annual gain comes to 229% following the latest surge, making investors sit up and take notice.

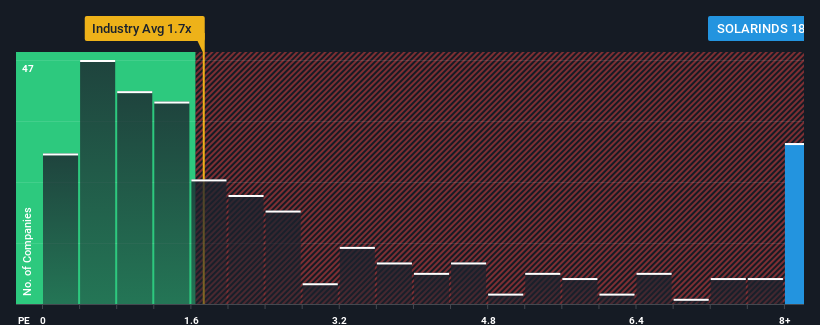

Since its price has surged higher, you could be forgiven for thinking Solar Industries India is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 18.1x, considering almost half the companies in India's Chemicals industry have P/S ratios below 1.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Solar Industries India

How Has Solar Industries India Performed Recently?

Solar Industries India has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Solar Industries India will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Solar Industries India?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Solar Industries India's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Even so, admirably revenue has lifted 141% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 31% as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this information, we can see why Solar Industries India is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Solar Industries India's P/S?

Solar Industries India's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Solar Industries India maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Solar Industries India with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Solar Industries India, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SOLARINDS

Solar Industries India

Engages in the manufacture and sale of industrial explosives and explosive initiating devices in India and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives