Sharda Cropchem Limited (NSE:SHARDACROP) Soars 43% But It's A Story Of Risk Vs Reward

The Sharda Cropchem Limited (NSE:SHARDACROP) share price has done very well over the last month, posting an excellent gain of 43%. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

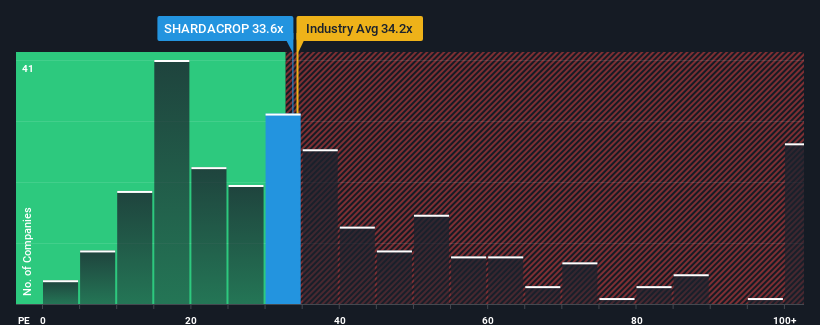

In spite of the firm bounce in price, it's still not a stretch to say that Sharda Cropchem's price-to-earnings (or "P/E") ratio of 33.6x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 33x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Sharda Cropchem has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Sharda Cropchem

Is There Some Growth For Sharda Cropchem?

In order to justify its P/E ratio, Sharda Cropchem would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 14% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 28% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 20% each year, which is noticeably less attractive.

In light of this, it's curious that Sharda Cropchem's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Sharda Cropchem's P/E

Sharda Cropchem appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sharda Cropchem's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Sharda Cropchem that you need to take into consideration.

If you're unsure about the strength of Sharda Cropchem's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHARDACROP

Sharda Cropchem

A crop protection chemical company, provides various formulations and generic active ingredients worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives