- India

- /

- Paper and Forestry Products

- /

- NSEI:SESHAPAPER

Seshasayee Paper and Boards (NSE:SESHAPAPER) Will Pay A Dividend Of ₹2.50

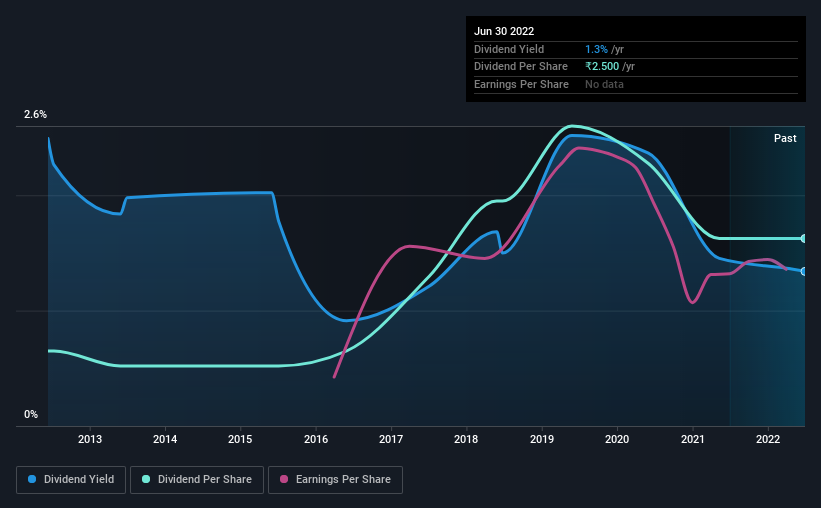

Seshasayee Paper and Boards Limited (NSE:SESHAPAPER) will pay a dividend of ₹2.50 on the 22nd of August. The dividend yield will be 1.3% based on this payment which is still above the industry average.

Check out our latest analysis for Seshasayee Paper and Boards

Seshasayee Paper and Boards' Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, prior to this announcement, Seshasayee Paper and Boards' dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Unless the company can turn things around, EPS could fall by 2.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 15%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was ₹1.00 in 2012, and the most recent fiscal year payment was ₹2.50. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Seshasayee Paper and Boards might have put its house in order since then, but we remain cautious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's not great to see that Seshasayee Paper and Boards' earnings per share has fallen at approximately 2.7% per year over the past five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Seshasayee Paper and Boards' payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Seshasayee Paper and Boards is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Seshasayee Paper and Boards (of which 1 can't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SESHAPAPER

Seshasayee Paper and Boards

Engages in the manufacture and sale of printing and writing paper in India.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026