- India

- /

- Basic Materials

- /

- NSEI:RHIM

Why We're Not Concerned Yet About RHI Magnesita India Limited's (NSE:RHIM) 27% Share Price Plunge

The RHI Magnesita India Limited (NSE:RHIM) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

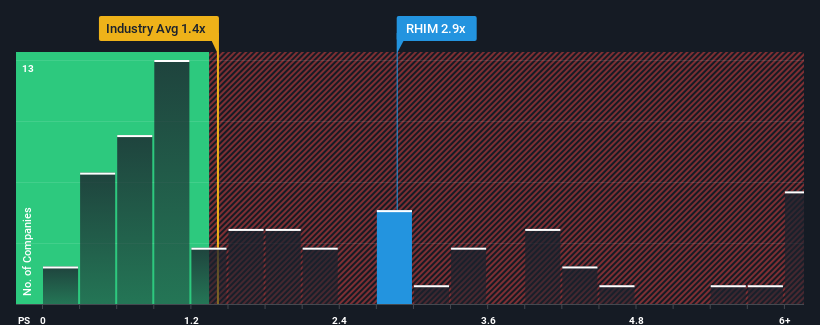

Even after such a large drop in price, given close to half the companies operating in India's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider RHI Magnesita India as a stock to potentially avoid with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for RHI Magnesita India

What Does RHI Magnesita India's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, RHI Magnesita India has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on RHI Magnesita India will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like RHI Magnesita India's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 17% as estimated by the two analysts watching the company. That would be an excellent outcome when the industry is expected to decline by 12%.

With this in consideration, we understand why RHI Magnesita India's P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Key Takeaway

There's still some elevation in RHI Magnesita India's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We can see that RHI Magnesita India maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

You always need to take note of risks, for example - RHI Magnesita India has 2 warning signs we think you should be aware of.

If you're unsure about the strength of RHI Magnesita India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RHIM

RHI Magnesita India

Engages in the manufacture and trading of refractories, monolithics, bricks, and ceramic paper in India and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives