- India

- /

- Metals and Mining

- /

- NSEI:RATNAMANI

Here's Why I Think Ratnamani Metals & Tubes (NSE:RATNAMANI) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Ratnamani Metals & Tubes (NSE:RATNAMANI), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Ratnamani Metals & Tubes

How Fast Is Ratnamani Metals & Tubes Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Ratnamani Metals & Tubes managed to grow EPS by 13% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

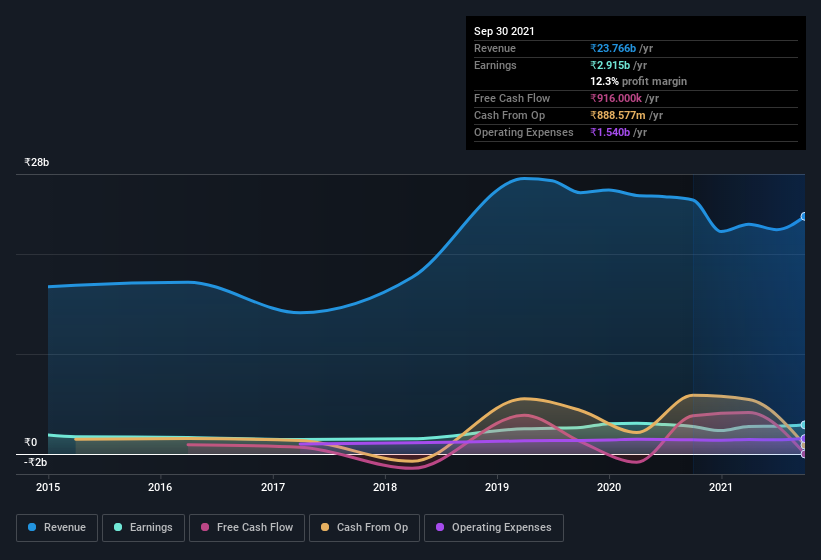

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Ratnamani Metals & Tubes's revenue dropped 6.4% last year, but the silver lining is that EBIT margins improved from 12% to 16%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Ratnamani Metals & Tubes's balance sheet strength, before getting too excited.

Are Ratnamani Metals & Tubes Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Ratnamani Metals & Tubes insiders own a meaningful share of the business. In fact, they own 66% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping ₹59b. That means they have plenty of their own capital riding on the performance of the business!

Does Ratnamani Metals & Tubes Deserve A Spot On Your Watchlist?

One positive for Ratnamani Metals & Tubes is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. We don't want to rain on the parade too much, but we did also find 1 warning sign for Ratnamani Metals & Tubes that you need to be mindful of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Ratnamani Metals & Tubes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RATNAMANI

Ratnamani Metals & Tubes

Manufactures and sells stainless steel pipes and tubes, and carbon steel pipes in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives