- India

- /

- Basic Materials

- /

- NSEI:RAMCOIND

Insiders with their considerable ownership were the key benefactors as Ramco Industries Limited (NSE:RAMCOIND) touches ₹19b market cap

Key Insights

- Insiders appear to have a vested interest in Ramco Industries' growth, as seen by their sizeable ownership

- A total of 6 investors have a majority stake in the company with 52% ownership

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

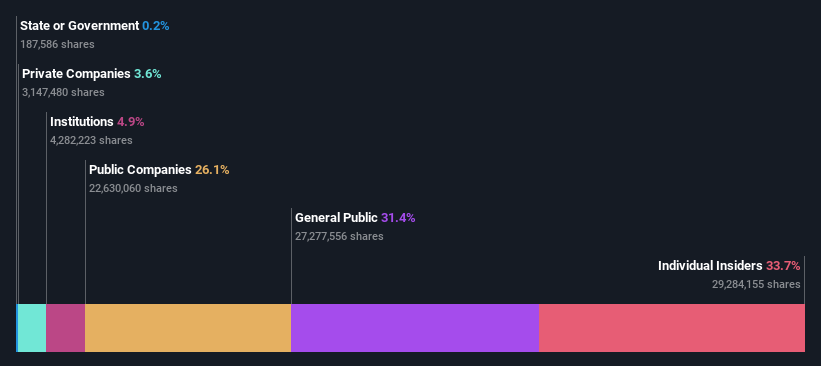

Every investor in Ramco Industries Limited (NSE:RAMCOIND) should be aware of the most powerful shareholder groups. With 34% stake, individual insiders possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, insiders scored the highest last week as the company hit ₹19b market cap following a 11% gain in the stock.

Let's delve deeper into each type of owner of Ramco Industries, beginning with the chart below.

Check out our latest analysis for Ramco Industries

What Does The Institutional Ownership Tell Us About Ramco Industries?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

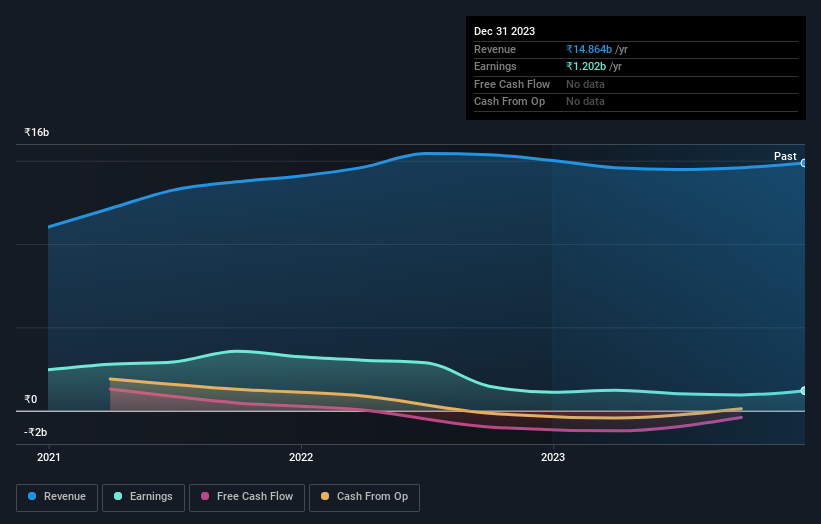

Less than 5% of Ramco Industries is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. So if the company itself can improve over time, we may well see more institutional buyers in the future. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don't have many shares in Ramco Industries. The company's largest shareholder is The Ramco Cements Limited, with ownership of 16%. Meanwhile, the second and third largest shareholders, hold 9.7% and 7.2%, of the shares outstanding, respectively. Poosapadi Ramasubrahmaneya Venketrama Raja, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board.

We did some more digging and found that 6 of the top shareholders account for roughly 52% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Ramco Industries

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Ramco Industries Limited. Insiders have a ₹6.5b stake in this ₹19b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 31% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Ramco Industries. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 3.6%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

We can see that public companies hold 26% of the Ramco Industries shares on issue. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Ramco Industries (1 is potentially serious!) that you should be aware of before investing here.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAMCOIND

Ramco Industries

Engages in the building products, textiles, and power generation businesses in India.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026