Rallis India Limited Just Missed EPS By 6.5%: Here's What Analysts Think Will Happen Next

It's shaping up to be a tough period for Rallis India Limited (NSE:RALLIS), which a week ago released some disappointing annual results that could have a notable impact on how the market views the stock. Rallis India missed analyst forecasts, with revenues of ₹27b and statutory earnings per share (EPS) of ₹7.61, falling short by 2.2% and 6.5% respectively. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Rallis India

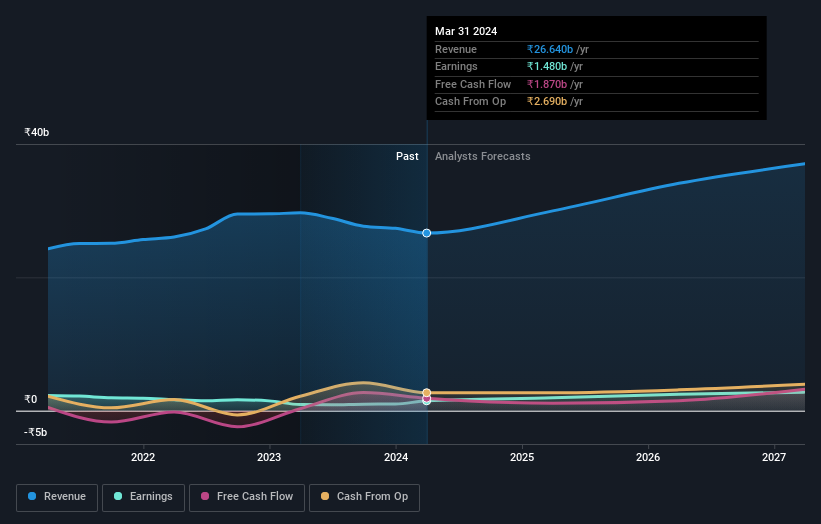

Taking into account the latest results, the current consensus from Rallis India's 14 analysts is for revenues of ₹30.0b in 2025. This would reflect a meaningful 12% increase on its revenue over the past 12 months. Per-share earnings are expected to soar 30% to ₹9.91. In the lead-up to this report, the analysts had been modelling revenues of ₹31.1b and earnings per share (EPS) of ₹10.53 in 2025. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

Despite the cuts to forecast earnings, there was no real change to the ₹242 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Rallis India, with the most bullish analyst valuing it at ₹327 and the most bearish at ₹165 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Rallis India's growth to accelerate, with the forecast 12% annualised growth to the end of 2025 ranking favourably alongside historical growth of 7.2% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 12% annually. Rallis India is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Sadly, they also downgraded their revenue forecasts, but the business is still expected to grow at roughly the same rate as the industry itself. The consensus price target held steady at ₹242, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Rallis India going out to 2027, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for Rallis India that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RALLIS

Rallis India

Manufactures and markets crop care and seed products in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.