- India

- /

- Basic Materials

- /

- NSEI:PRSMJOHNSN

The total return for Prism Johnson (NSE:PRSMJOHNSN) investors has risen faster than earnings growth over the last five years

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. But Prism Johnson Limited (NSE:PRSMJOHNSN) has fallen short of that second goal, with a share price rise of 95% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 18%.

While the stock has fallen 6.7% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Prism Johnson

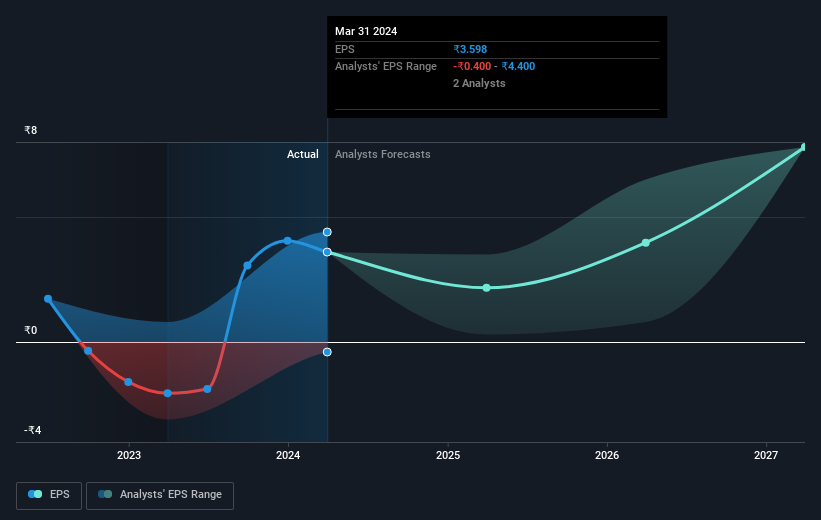

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Prism Johnson became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Prism Johnson has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Prism Johnson will grow revenue in the future.

A Different Perspective

Prism Johnson shareholders gained a total return of 18% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 14% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Prism Johnson better, we need to consider many other factors. Even so, be aware that Prism Johnson is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PRSMJOHNSN

Prism Johnson

An integrated building materials company, manufactures and sells cement, tiles, and ready-mixed concrete in India and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026