Does Privi Speciality Chemicals (NSE:PRIVISCL) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Privi Speciality Chemicals Limited (NSE:PRIVISCL) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Privi Speciality Chemicals

What Is Privi Speciality Chemicals's Net Debt?

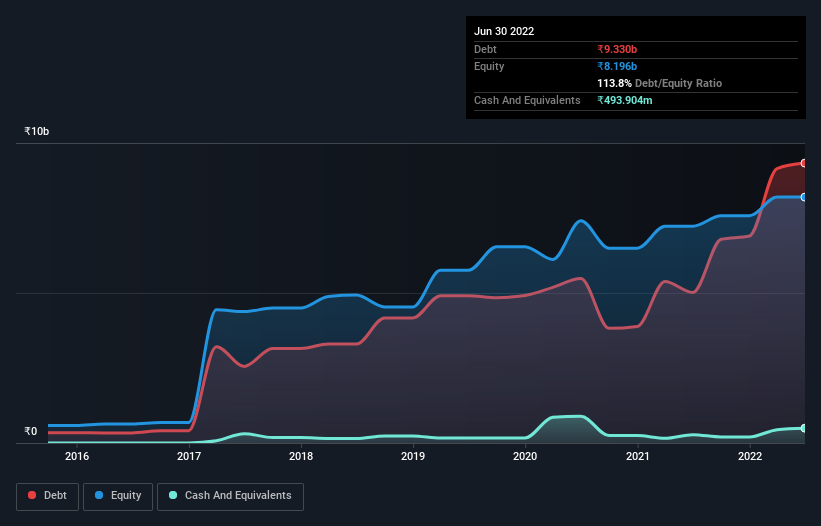

The image below, which you can click on for greater detail, shows that at March 2022 Privi Speciality Chemicals had debt of ₹9.33b, up from ₹5.02b in one year. However, it does have ₹493.9m in cash offsetting this, leading to net debt of about ₹8.84b.

How Healthy Is Privi Speciality Chemicals' Balance Sheet?

The latest balance sheet data shows that Privi Speciality Chemicals had liabilities of ₹9.29b due within a year, and liabilities of ₹4.28b falling due after that. Offsetting this, it had ₹493.9m in cash and ₹3.50b in receivables that were due within 12 months. So its liabilities total ₹9.57b more than the combination of its cash and short-term receivables.

Of course, Privi Speciality Chemicals has a market capitalization of ₹61.6b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Privi Speciality Chemicals's debt is 4.7 times its EBITDA, and its EBIT cover its interest expense 3.9 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even worse, Privi Speciality Chemicals saw its EBIT tank 20% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Privi Speciality Chemicals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Privi Speciality Chemicals saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Privi Speciality Chemicals's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to handle its total liabilities isn't such a worry. We're quite clear that we consider Privi Speciality Chemicals to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Privi Speciality Chemicals (1 is significant!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRIVISCL

Privi Speciality Chemicals

Operates as a manufacturer, supplier, and exporter of aroma and fragrance chemicals in India, North America, Asia, the Middle East, Africa, Europe, South America, and the United Kingdom.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives