With EPS Growth And More, Huhtamaki PPL (NSE:PAPERPROD) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Huhtamaki PPL (NSE:PAPERPROD). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Huhtamaki PPL

Huhtamaki PPL's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Huhtamaki PPL's stratospheric annual EPS growth of 40%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

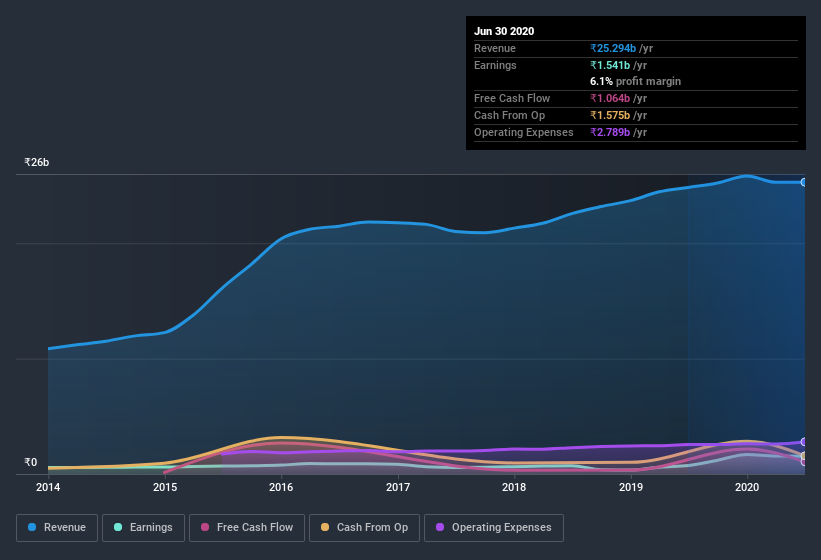

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It seems Huhtamaki PPL is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Huhtamaki PPL?

Are Huhtamaki PPL Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Huhtamaki PPL shares worth a considerable sum. To be specific, they have ₹1.1b worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Huhtamaki PPL Worth Keeping An Eye On?

Huhtamaki PPL's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Huhtamaki PPL for a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Huhtamaki PPL , and understanding this should be part of your investment process.

Although Huhtamaki PPL certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Huhtamaki PPL or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huhtamaki India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HUHTAMAKI

Huhtamaki India

Engages in the manufacture and sale of flexible consumer packaging and labelling solutions in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives