Oriental Aromatics (NSE:OAL) Is Due To Pay A Dividend Of ₹0.50

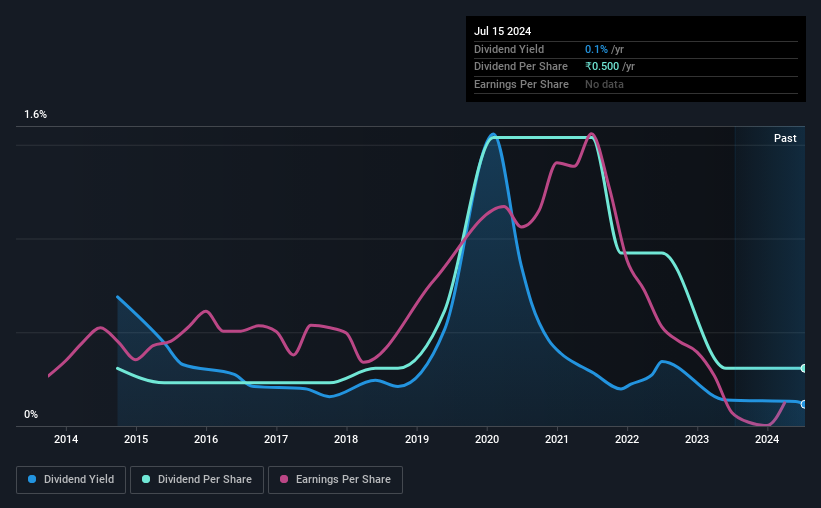

Oriental Aromatics Limited's (NSE:OAL) investors are due to receive a payment of ₹0.50 per share on 20th of September. Including this payment, the dividend yield on the stock will be 0.1%, which is a modest boost for shareholders' returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Oriental Aromatics' stock price has increased by 34% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Oriental Aromatics

Oriental Aromatics' Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Oriental Aromatics' dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Unless the company can turn things around, EPS could fall by 30.7% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 28%, which is definitely feasible to continue.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The payments haven't really changed that much since 10 years ago. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 31% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Oriental Aromatics' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Oriental Aromatics (of which 1 can't be ignored!) you should know about. Is Oriental Aromatics not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:OAL

Oriental Aromatics

Manufactures and sells terpene chemicals, camphor, and other specialty aroma ingredients in India.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives