Could The Neogen Chemicals Limited (NSE:NEOGEN) Ownership Structure Tell Us Something Useful?

If you want to know who really controls Neogen Chemicals Limited (NSE:NEOGEN), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

Neogen Chemicals is a smaller company with a market capitalization of ₹17b, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about Neogen Chemicals.

Check out our latest analysis for Neogen Chemicals

What Does The Institutional Ownership Tell Us About Neogen Chemicals?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

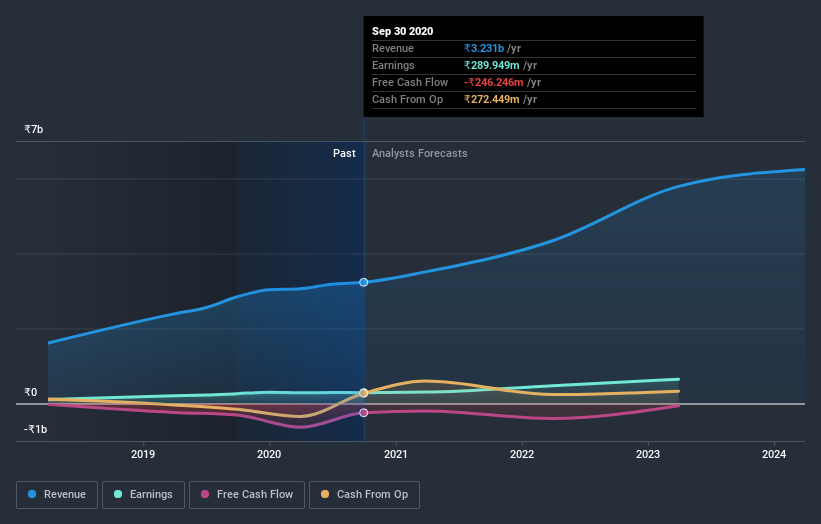

Neogen Chemicals already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Neogen Chemicals, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in Neogen Chemicals. The company's CEO Haridas Kanani is the largest shareholder with 56% of shares outstanding. With such a huge stake, we infer that they have significant control of the future of the company. It's usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider with such skin in the game. In comparison, the second and third largest shareholders hold about 8.6% and 5.3% of the stock. Interestingly, the second-largest shareholder, Harin Kanani is also Co-Chief Executive Officer, again, pointing towards strong insider ownership amongst the company's top shareholders.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Neogen Chemicals

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems that insiders own more than half the Neogen Chemicals Limited stock. This gives them a lot of power. Given it has a market cap of ₹17b, that means they have ₹12b worth of shares. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 11% ownership, the general public have some degree of sway over Neogen Chemicals. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Neogen Chemicals (including 1 which shouldn't be ignored) .

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Neogen Chemicals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Neogen Chemicals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Neogen Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NEOGEN

Neogen Chemicals

Engages in the manufacture and sale of specialty chemicals in India.

High growth potential with solid track record.