Nahar Poly Films' (NSE:NAHARPOLY) Shareholders Will Receive A Bigger Dividend Than Last Year

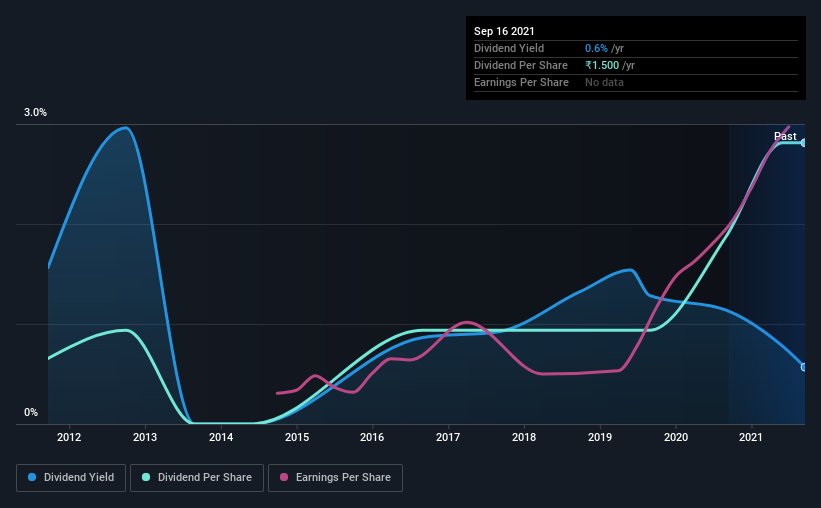

Nahar Poly Films Limited (NSE:NAHARPOLY) has announced that it will be increasing its dividend on the 10th of October to ₹1.50. This will take the annual payment from 0.6% to 1.1% of the stock price, which is above what most companies in the industry pay.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Nahar Poly Films' stock price has increased by 73% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Nahar Poly Films

Nahar Poly Films' Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Nahar Poly Films' earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share could rise by 35.9% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 9.7% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was ₹0.35, compared to the most recent full-year payment of ₹1.50. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Nahar Poly Films has grown earnings per share at 36% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

Our Thoughts On Nahar Poly Films' Dividend

Overall, we always like to see the dividend being raised, but we don't think Nahar Poly Films will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 3 warning signs for Nahar Poly Films that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Nahar Poly Films, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nahar Poly Films might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NAHARPOLY

Nahar Poly Films

Manufactures and sells bi-axially oriented polypropylene films in India and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026