- India

- /

- Metals and Mining

- /

- NSEI:MIDHANI

Mishra Dhatu Nigam Limited's (NSE:MIDHANI) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- Mishra Dhatu Nigam will host its Annual General Meeting on 30th of September

- Total pay for CEO Sanjay Jha includes ₹5.84m salary

- Total compensation is 73% below industry average

- Mishra Dhatu Nigam's total shareholder return over the past three years was 121% while its EPS was down 25% over the past three years

Performance at Mishra Dhatu Nigam Limited (NSE:MIDHANI) has been rather uninspiring recently and shareholders may be wondering how CEO Sanjay Jha plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 30th of September. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Mishra Dhatu Nigam

Comparing Mishra Dhatu Nigam Limited's CEO Compensation With The Industry

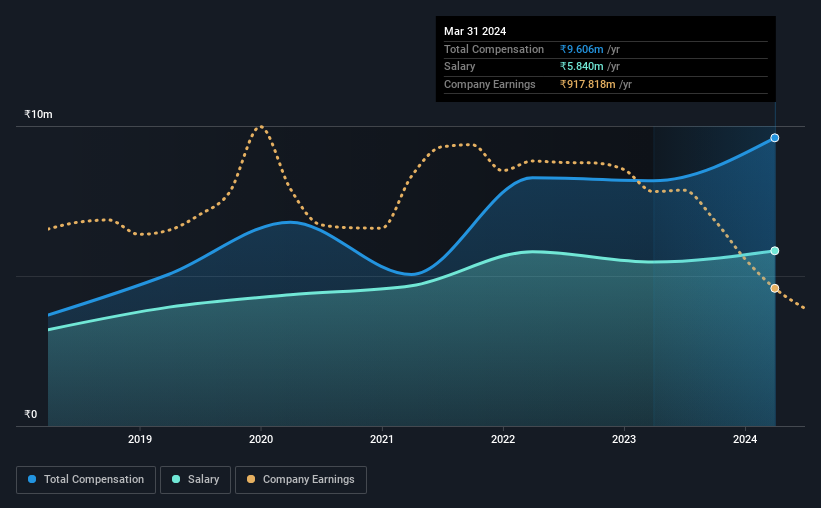

According to our data, Mishra Dhatu Nigam Limited has a market capitalization of ₹74b, and paid its CEO total annual compensation worth ₹9.6m over the year to March 2024. Notably, that's an increase of 17% over the year before. We note that the salary portion, which stands at ₹5.84m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Indian Metals and Mining industry with market capitalizations ranging between ₹33b and ₹134b had a median total CEO compensation of ₹36m. In other words, Mishra Dhatu Nigam pays its CEO lower than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹5.8m | ₹5.5m | 61% |

| Other | ₹3.8m | ₹2.7m | 39% |

| Total Compensation | ₹9.6m | ₹8.2m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.14164306% is other remuneration. Mishra Dhatu Nigam sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Mishra Dhatu Nigam Limited's Growth

Over the last three years, Mishra Dhatu Nigam Limited has shrunk its earnings per share by 25% per year. In the last year, its revenue is up 11%.

Few shareholders would be pleased to read that EPS have declined. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Mishra Dhatu Nigam Limited Been A Good Investment?

Boasting a total shareholder return of 121% over three years, Mishra Dhatu Nigam Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Mishra Dhatu Nigam that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MIDHANI

Mishra Dhatu Nigam

Manufactures and sells super alloys, titanium, special purpose steel, and other special metals in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026