If You Like EPS Growth Then Check Out Mangalore Chemicals & Fertilizers (NSE:MANGCHEFER) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Mangalore Chemicals & Fertilizers (NSE:MANGCHEFER). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Mangalore Chemicals & Fertilizers

How Fast Is Mangalore Chemicals & Fertilizers Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Mangalore Chemicals & Fertilizers has managed to grow EPS by 19% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

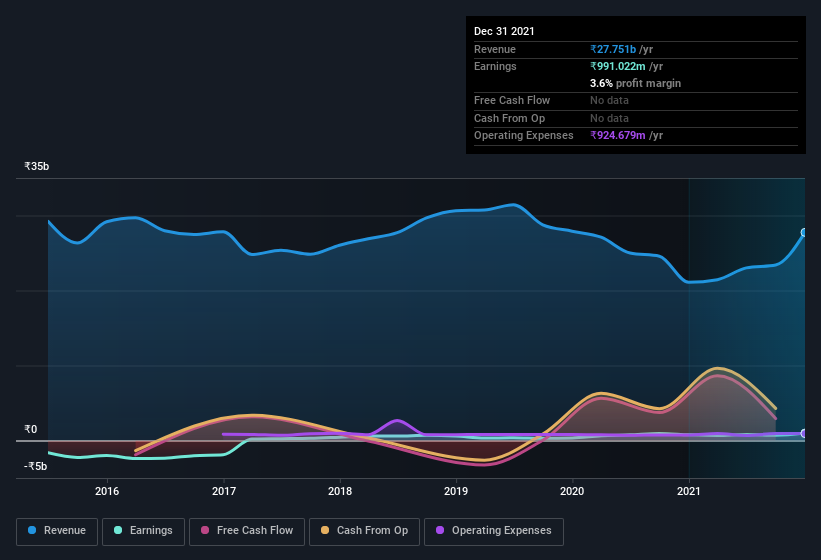

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Mangalore Chemicals & Fertilizers did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Mangalore Chemicals & Fertilizers is no giant, with a market capitalization of ₹11b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mangalore Chemicals & Fertilizers Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Mangalore Chemicals & Fertilizers insiders reported share sales in the last twelve months. But the really good news is that Non-Executive Chairman Akshay Poddar spent ₹20m buying stock stock, at an average price of around ₹75.34. Big buys like that give me a sense of opportunity; actions speak louder than words.

Should You Add Mangalore Chemicals & Fertilizers To Your Watchlist?

For growth investors like me, Mangalore Chemicals & Fertilizers's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe Mangalore Chemicals & Fertilizers is probably worth spending some time on. We should say that we've discovered 3 warning signs for Mangalore Chemicals & Fertilizers that you should be aware of before investing here.

The good news is that Mangalore Chemicals & Fertilizers is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MANGCHEFER

Mangalore Chemicals & Fertilizers

Engages in the manufacture, trading, and sale of nitrogenous and phosphatic fertilizers in India.

Adequate balance sheet slight.