- India

- /

- Metals and Mining

- /

- NSEI:MAHSEAMLES

Maharashtra Seamless Limited's (NSE:MAHSEAMLES) Prospects Need A Boost To Lift Shares

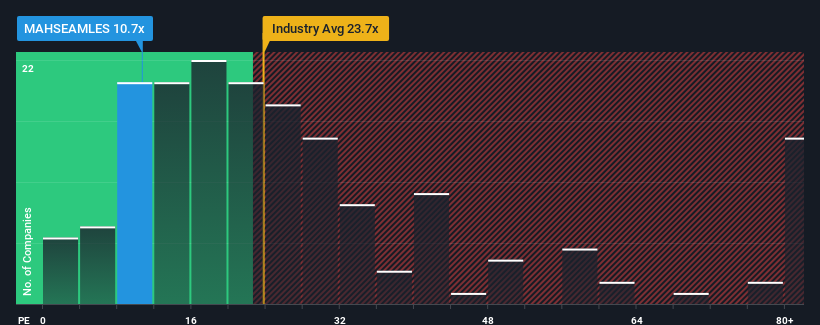

Maharashtra Seamless Limited's (NSE:MAHSEAMLES) price-to-earnings (or "P/E") ratio of 10.7x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 59x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Maharashtra Seamless as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Maharashtra Seamless

Is There Any Growth For Maharashtra Seamless?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Maharashtra Seamless' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 73% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to slump, contracting by 13% during the coming year according to the only analyst following the company. Meanwhile, the broader market is forecast to expand by 24%, which paints a poor picture.

With this information, we are not surprised that Maharashtra Seamless is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Maharashtra Seamless' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Maharashtra Seamless has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Maharashtra Seamless. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHSEAMLES

Maharashtra Seamless

Engages in the manufacture and sale of seamless steel pipes and tubes in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026