Laxmi Organic Industries Limited (NSE:LXCHEM) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Most readers would already be aware that Laxmi Organic Industries' (NSE:LXCHEM) stock increased significantly by 14% over the past week. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Particularly, we will be paying attention to Laxmi Organic Industries' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Our free stock report includes 1 warning sign investors should be aware of before investing in Laxmi Organic Industries. Read for free now.How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Laxmi Organic Industries is:

7.3% = ₹1.4b ÷ ₹19b (Based on the trailing twelve months to December 2024).

The 'return' is the yearly profit. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.07 in profit.

View our latest analysis for Laxmi Organic Industries

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Laxmi Organic Industries' Earnings Growth And 7.3% ROE

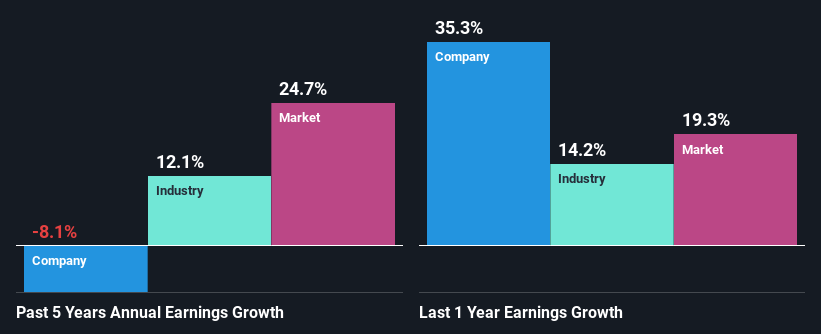

It is hard to argue that Laxmi Organic Industries' ROE is much good in and of itself. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. For this reason, Laxmi Organic Industries' five year net income decline of 8.1% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

That being said, we compared Laxmi Organic Industries' performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 12% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Laxmi Organic Industries fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Laxmi Organic Industries Making Efficient Use Of Its Profits?

When we piece together Laxmi Organic Industries' low three-year median payout ratio of 11% (where it is retaining 89% of its profits), calculated for the last three-year period, we are puzzled by the lack of growth. This typically shouldn't be the case when a company is retaining most of its earnings. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Moreover, Laxmi Organic Industries has been paying dividends for four years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 8.5% over the next three years. The fact that the company's ROE is expected to rise to 11% over the same period is explained by the drop in the payout ratio.

Conclusion

In total, we're a bit ambivalent about Laxmi Organic Industries' performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LXCHEM

Laxmi Organic Industries

Manufactures and trades acetyl intermediates and specialty chemicals in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.