Did You Manage To Avoid Lloyds Steels Industries's (NSE:LLOYDSTEEL) Painful 62% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Even the best stock pickers will make plenty of bad investments. Unfortunately, shareholders of Lloyds Steels Industries Limited (NSE:LLOYDSTEEL) have suffered share price declines over the last year. The share price is down a hefty 62% in that time. Lloyds Steels Industries may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 50% in about a quarter. That's not much fun for holders.

View our latest analysis for Lloyds Steels Industries

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Lloyds Steels Industries share price fell, it actually saw its earnings per share (EPS) improve by 101%. Of course, the situation might betray previous over-optimism about growth. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

Lloyds Steels Industries's revenue is actually up 40% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

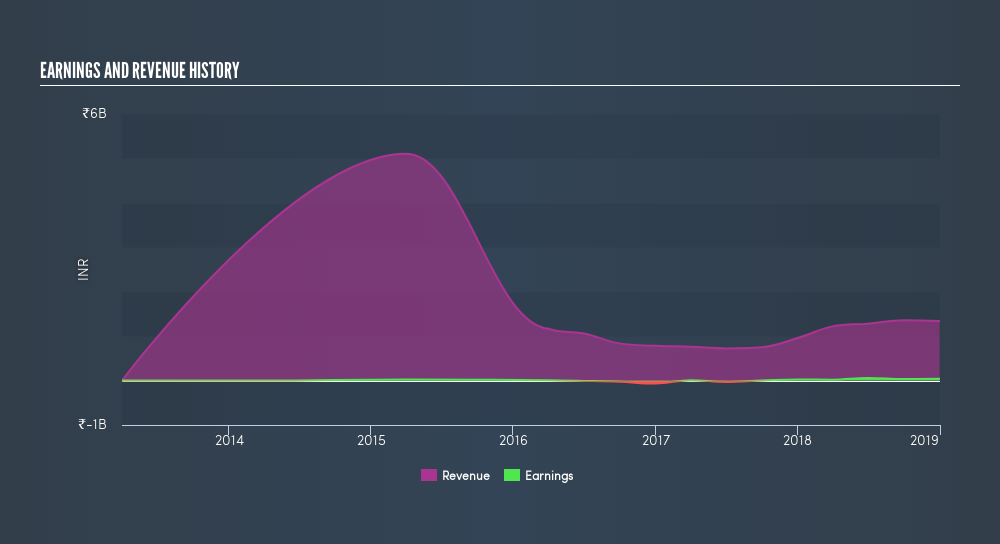

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Lloyds Steels Industries's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Lloyds Steels Industries shareholders are down 62% for the year, even worse than the market loss of 0.2%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 50% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Is Lloyds Steels Industries cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:LLOYDSENGG

Lloyds Engineering Works

Provides engineering products and services in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives