Lords Chloro Alkali Limited's (NSE:LORDSCHLO) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Lords Chloro Alkali Limited (NSE:LORDSCHLO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

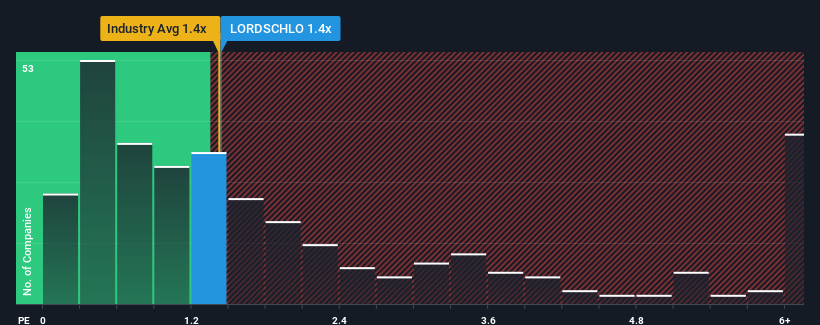

In spite of the heavy fall in price, it's still not a stretch to say that Lords Chloro Alkali's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Chemicals industry in India, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Lords Chloro Alkali

How Has Lords Chloro Alkali Performed Recently?

The revenue growth achieved at Lords Chloro Alkali over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lords Chloro Alkali will help you shine a light on its historical performance.How Is Lords Chloro Alkali's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Lords Chloro Alkali's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. As a result, it also grew revenue by 22% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Lords Chloro Alkali is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Lords Chloro Alkali's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Lords Chloro Alkali looks to be in line with the rest of the Chemicals industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lords Chloro Alkali's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It is also worth noting that we have found 3 warning signs for Lords Chloro Alkali (1 is concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LORDSCHLO

Lords Chloro Alkali

Engages in the manufacture and sale of caustic soda and other chemical products in India.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives