Investor Optimism Abounds Krishca Strapping Solutions Limited (NSE:KRISHCA) But Growth Is Lacking

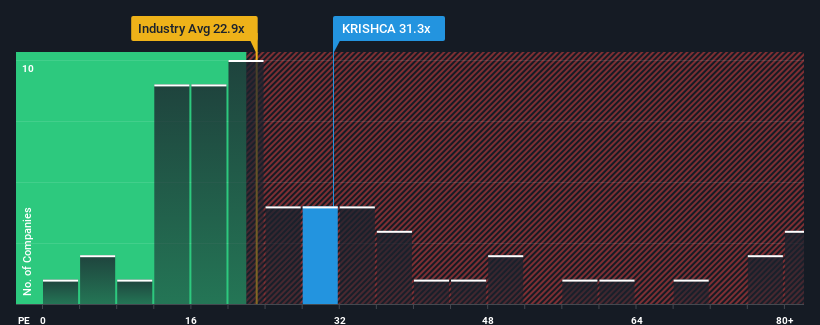

There wouldn't be many who think Krishca Strapping Solutions Limited's (NSE:KRISHCA) price-to-earnings (or "P/E") ratio of 31.3x is worth a mention when the median P/E in India is similar at about 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Krishca Strapping Solutions has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Krishca Strapping Solutions

How Is Krishca Strapping Solutions' Growth Trending?

In order to justify its P/E ratio, Krishca Strapping Solutions would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 380% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Krishca Strapping Solutions is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Krishca Strapping Solutions' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Krishca Strapping Solutions currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Krishca Strapping Solutions has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might also be able to find a better stock than Krishca Strapping Solutions. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Krishca Strapping Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRISHCA

Krishca Strapping Solutions

Engages in the manufacture and wholesale of strapping steel, steel seals, and strapping tools in India.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026