If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in KIOCL's (NSE:KIOCL) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for KIOCL:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = ₹5.4b ÷ (₹27b - ₹4.1b) (Based on the trailing twelve months to September 2021).

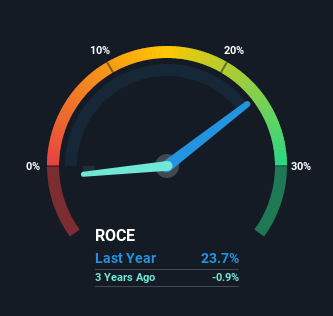

So, KIOCL has an ROCE of 24%. That's a fantastic return and not only that, it outpaces the average of 16% earned by companies in a similar industry.

See our latest analysis for KIOCL

Historical performance is a great place to start when researching a stock so above you can see the gauge for KIOCL's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of KIOCL, check out these free graphs here.

How Are Returns Trending?

Shareholders will be relieved that KIOCL has broken into profitability. While the business was unprofitable in the past, it's now turned things around and is earning 24% on its capital. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. That being said, while an increase in efficiency is no doubt appealing, it'd be helpful to know if the company does have any investment plans going forward. Because in the end, a business can only get so efficient.

The Key Takeaway

To sum it up, KIOCL is collecting higher returns from the same amount of capital, and that's impressive. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. In light of that, we think it's worth looking further into this stock because if KIOCL can keep these trends up, it could have a bright future ahead.

If you want to know some of the risks facing KIOCL we've found 2 warning signs (1 is significant!) that you should be aware of before investing here.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if KIOCL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIOCL

KIOCL

Engages in the iron ore mining, beneficiation, and production of pellets in India and internationally.

Adequate balance sheet very low.