Does Kingfa Science & Technology (India) (NSE:KINGFA) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Kingfa Science & Technology (India) Limited (NSE:KINGFA) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Kingfa Science & Technology (India)

How Much Debt Does Kingfa Science & Technology (India) Carry?

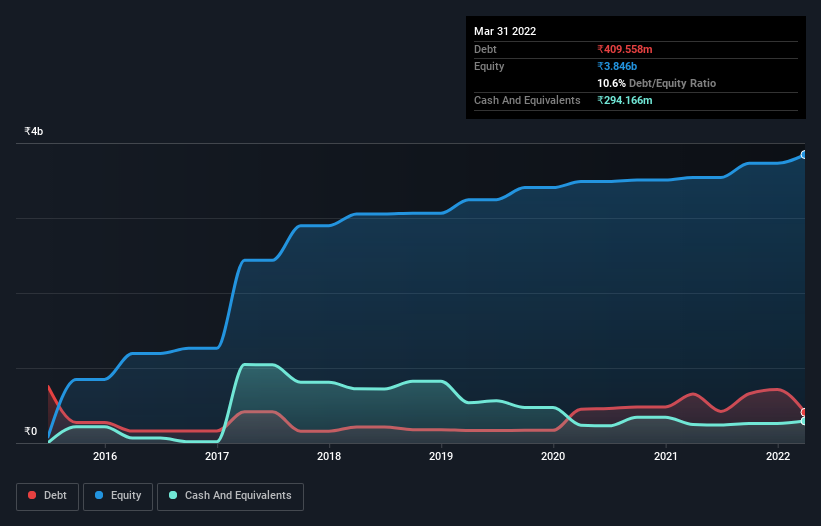

You can click the graphic below for the historical numbers, but it shows that Kingfa Science & Technology (India) had ₹409.6m of debt in March 2022, down from ₹653.4m, one year before. However, it does have ₹294.2m in cash offsetting this, leading to net debt of about ₹115.4m.

A Look At Kingfa Science & Technology (India)'s Liabilities

The latest balance sheet data shows that Kingfa Science & Technology (India) had liabilities of ₹4.68b due within a year, and liabilities of ₹245.2m falling due after that. Offsetting this, it had ₹294.2m in cash and ₹2.83b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹1.80b.

Since publicly traded Kingfa Science & Technology (India) shares are worth a total of ₹10.1b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Kingfa Science & Technology (India) has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Kingfa Science & Technology (India)'s net debt is only 0.13 times its EBITDA. And its EBIT covers its interest expense a whopping 14.5 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Better yet, Kingfa Science & Technology (India) grew its EBIT by 649% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Kingfa Science & Technology (India) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Kingfa Science & Technology (India) burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Kingfa Science & Technology (India)'s interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that Kingfa Science & Technology (India) can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with Kingfa Science & Technology (India) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Kingfa Science & Technology (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KINGFA

Kingfa Science & Technology (India)

Manufactures and supplies reinforced polypropylene compounds, thermoplastics elastomers, and personal protective equipment masks and gloves in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026