A Quick Analysis On Kansai Nerolac Paints' (NSE:KANSAINER) CEO Salary

Harishchandra Meghraj Bharuka has been the CEO of Kansai Nerolac Paints Limited (NSE:KANSAINER) since 2004, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Kansai Nerolac Paints pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Kansai Nerolac Paints

How Does Total Compensation For Harishchandra Meghraj Bharuka Compare With Other Companies In The Industry?

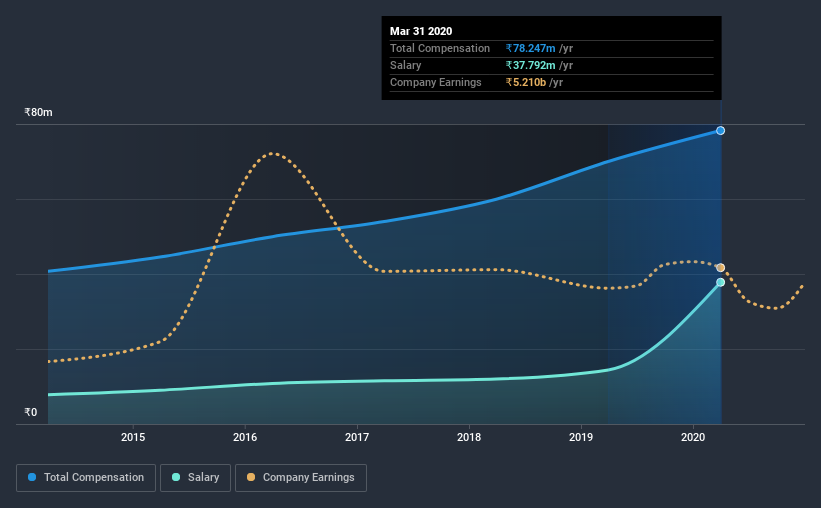

At the time of writing, our data shows that Kansai Nerolac Paints Limited has a market capitalization of ₹303b, and reported total annual CEO compensation of ₹78m for the year to March 2020. Notably, that's an increase of 12% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹38m.

On examining similar-sized companies in the industry with market capitalizations between ₹145b and ₹465b, we discovered that the median CEO total compensation of that group was ₹67m. This suggests that Kansai Nerolac Paints remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹38m | ₹14m | 48% |

| Other | ₹40m | ₹56m | 52% |

| Total Compensation | ₹78m | ₹70m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. In Kansai Nerolac Paints' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Kansai Nerolac Paints Limited's Growth

Kansai Nerolac Paints Limited has reduced its earnings per share by 2.8% a year over the last three years. Its revenue is down 13% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Kansai Nerolac Paints Limited Been A Good Investment?

With a total shareholder return of 18% over three years, Kansai Nerolac Paints Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As we noted earlier, Kansai Nerolac Paints pays its CEO in line with similar-sized companies belonging to the same industry. According to our analysis, Kansai Nerolac Paints is suffering from uninspiring EPS growth, and even though shareholder returns are stable, they are hardly impressive. This doesn't compare well with CEO compensation, which is largely in line with the industry median. We wouldn't go as far as saying CEO compensation is inappropriate, but we don't think the executive is underpaid.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Kansai Nerolac Paints that you should be aware of before investing.

Switching gears from Kansai Nerolac Paints, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Kansai Nerolac Paints or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kansai Nerolac Paints might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KANSAINER

Kansai Nerolac Paints

Manufactures and supplies paints and varnishes, enamels, and lacquers in India.

Excellent balance sheet average dividend payer.