- India

- /

- Metals and Mining

- /

- NSEI:JSLHISAR

Do Jindal Stainless (Hisar)'s (NSE:JSLHISAR) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jindal Stainless (Hisar) (NSE:JSLHISAR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Jindal Stainless (Hisar) with the means to add long-term value to shareholders.

Our analysis indicates that JSLHISAR is potentially undervalued!

Jindal Stainless (Hisar)'s Improving Profits

In the last three years Jindal Stainless (Hisar)'s earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Jindal Stainless (Hisar)'s EPS skyrocketed from ₹48.50 to ₹80.20, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 65%.

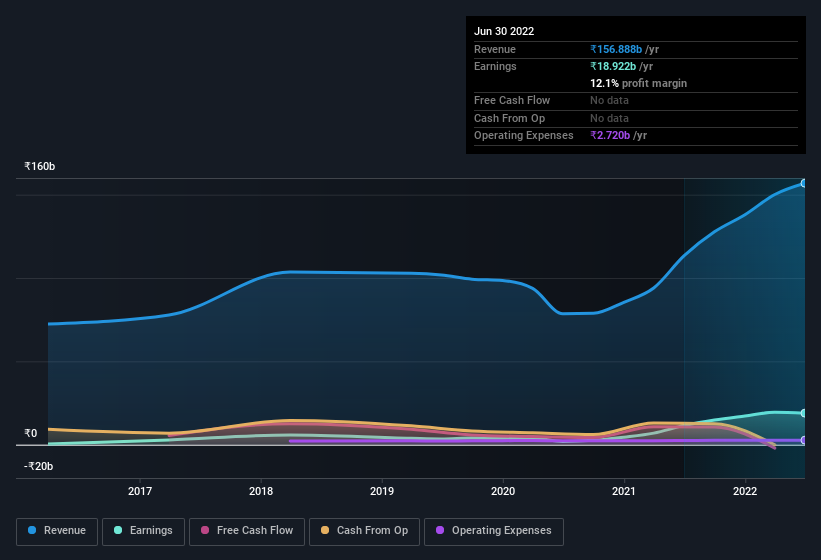

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Jindal Stainless (Hisar) maintained stable EBIT margins over the last year, all while growing revenue 39% to ₹157b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Jindal Stainless (Hisar)'s balance sheet strength, before getting too excited.

Are Jindal Stainless (Hisar) Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Jindal Stainless (Hisar) shares, in the last year. Add in the fact that Nirmala Goel, the company insider of the company, paid ₹3.2m for shares at around ₹324 each. It seems that at least one insider is prepared to show the market there is potential within Jindal Stainless (Hisar).

The good news, alongside the insider buying, for Jindal Stainless (Hisar) bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have ₹2.4b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 3.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Jindal Stainless (Hisar) Worth Keeping An Eye On?

For growth investors, Jindal Stainless (Hisar)'s raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. What about risks? Every company has them, and we've spotted 1 warning sign for Jindal Stainless (Hisar) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Jindal Stainless (Hisar), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JSLHISAR

Jindal Stainless (Hisar)

Jindal Stainless (Hisar) Limited manufactures and sells stainless steel products worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives