- India

- /

- Basic Materials

- /

- NSEI:JKLAKSHMI

Investors Will Want JK Lakshmi Cement's (NSE:JKLAKSHMI) Growth In ROCE To Persist

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at JK Lakshmi Cement (NSE:JKLAKSHMI) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for JK Lakshmi Cement, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = ₹7.1b ÷ (₹53b - ₹15b) (Based on the trailing twelve months to March 2021).

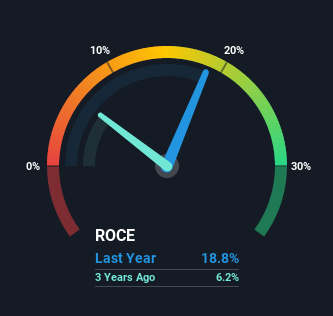

Therefore, JK Lakshmi Cement has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Basic Materials industry average of 13% it's much better.

View our latest analysis for JK Lakshmi Cement

In the above chart we have measured JK Lakshmi Cement's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From JK Lakshmi Cement's ROCE Trend?

JK Lakshmi Cement is showing promise given that its ROCE is trending up and to the right. The figures show that over the last five years, ROCE has grown 454% whilst employing roughly the same amount of capital. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

The Bottom Line On JK Lakshmi Cement's ROCE

To sum it up, JK Lakshmi Cement is collecting higher returns from the same amount of capital, and that's impressive. And with a respectable 64% awarded to those who held the stock over the last five years, you could argue that these developments are starting to get the attention they deserve. In light of that, we think it's worth looking further into this stock because if JK Lakshmi Cement can keep these trends up, it could have a bright future ahead.

On a separate note, we've found 3 warning signs for JK Lakshmi Cement you'll probably want to know about.

While JK Lakshmi Cement isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading JK Lakshmi Cement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:JKLAKSHMI

Reasonable growth potential with mediocre balance sheet.