- India

- /

- Metals and Mining

- /

- NSEI:JAYNECOIND

The 14% return this week takes Jayaswal Neco Industries' (NSE:JAYNECOIND) shareholders five-year gains to 766%

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the Jayaswal Neco Industries Limited (NSE:JAYNECOIND) share price is up a whopping 766% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 26% gain in the last three months. We love happy stories like this one. The company should be really proud of that performance!

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Jayaswal Neco Industries

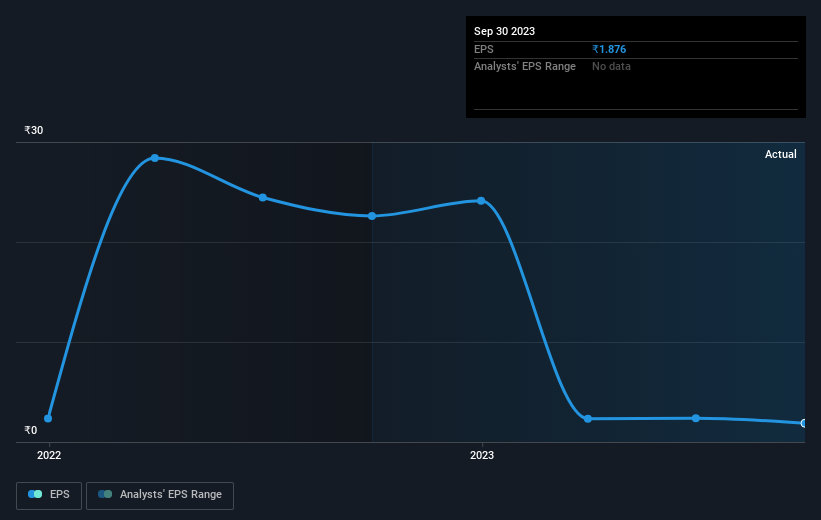

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Jayaswal Neco Industries became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Jayaswal Neco Industries' earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Jayaswal Neco Industries shareholders have received a total shareholder return of 91% over one year. That's better than the annualised return of 54% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Jayaswal Neco Industries better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Jayaswal Neco Industries (of which 1 is potentially serious!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JAYNECOIND

Jayaswal Neco Industries

Engages in the manufacture and sale of steel products, and iron and steel castings in India.

Good value with mediocre balance sheet.