- India

- /

- Basic Materials

- /

- NSEI:INDIACEM

Did Business Growth Power India Cements' (NSE:INDIACEM) Share Price Gain of 106%?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example The India Cements Limited (NSE:INDIACEM). Its share price is already up an impressive 106% in the last twelve months. It's also good to see the share price up 24% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 22% in 90 days). On the other hand, longer term shareholders have had a tougher run, with the stock falling 19% in three years.

Check out our latest analysis for India Cements

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, India Cements actually shrank its EPS by 24%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 0.4% dividend yield is doing much to support the share price. India Cements' revenue actually dropped 25% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

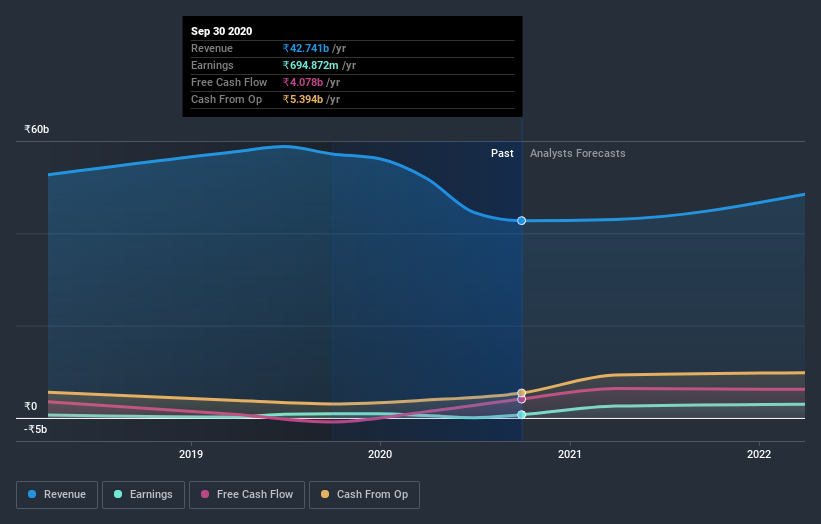

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on India Cements' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that India Cements shareholders have received a total shareholder return of 107% over one year. That's including the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with India Cements .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade India Cements, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INDIACEM

India Cements

Produces and sells cement and cement related products in India.

Reasonable growth potential with adequate balance sheet.