- India

- /

- Metals and Mining

- /

- NSEI:IMFA

Indian Metals and Ferro Alloys (NSE:IMFA) Will Pay A Larger Dividend Than Last Year At ₹7.50

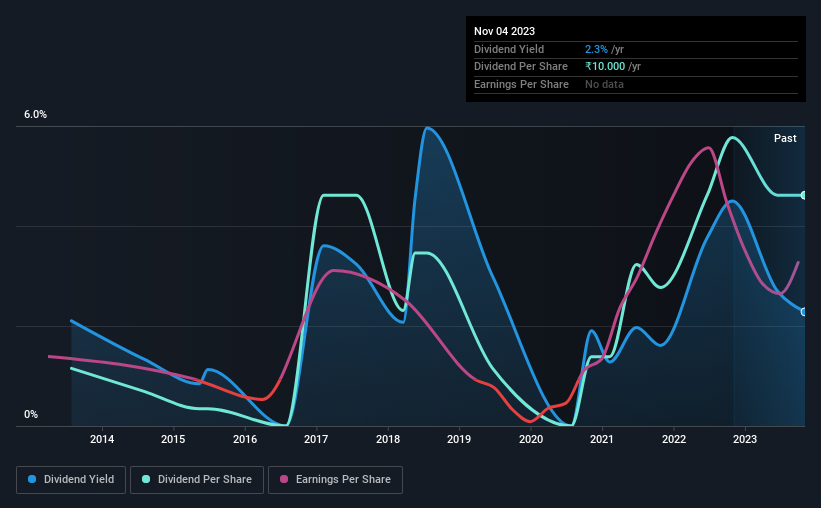

Indian Metals and Ferro Alloys Limited's (NSE:IMFA) periodic dividend will be increasing on the 2nd of December to ₹7.50, with investors receiving 50% more than last year's ₹5.00. Even though the dividend went up, the yield is still quite low at only 2.3%.

View our latest analysis for Indian Metals and Ferro Alloys

Indian Metals and Ferro Alloys' Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Indian Metals and Ferro Alloys was paying a whopping 127% as a dividend, but this only made up 9.8% of its overall earnings. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Over the next year, EPS could expand by 52.6% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 18% by next year, which is in a pretty sustainable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was ₹2.50 in 2013, and the most recent fiscal year payment was ₹10.00. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Indian Metals and Ferro Alloys has seen EPS rising for the last five years, at 53% per annum. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Our Thoughts On Indian Metals and Ferro Alloys' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Indian Metals and Ferro Alloys is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Indian Metals and Ferro Alloys that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IMFA

Indian Metals and Ferro Alloys

Engages in the production and sale of ferro chrome in India and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives