- India

- /

- Basic Materials

- /

- NSEI:IFGLEXPOR

Here's Why We Think IFGL Refractories (NSE:IFGLEXPOR) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like IFGL Refractories (NSE:IFGLEXPOR), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for IFGL Refractories

How Fast Is IFGL Refractories Growing Its Earnings Per Share?

Over the last three years, IFGL Refractories has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. IFGL Refractories' EPS shot up from ₹20.58 to ₹26.16; a result that's bound to keep shareholders happy. That's a commendable gain of 27%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that IFGL Refractories is growing revenues, and EBIT margins improved by 3.1 percentage points to 9.9%, over the last year. That's great to see, on both counts.

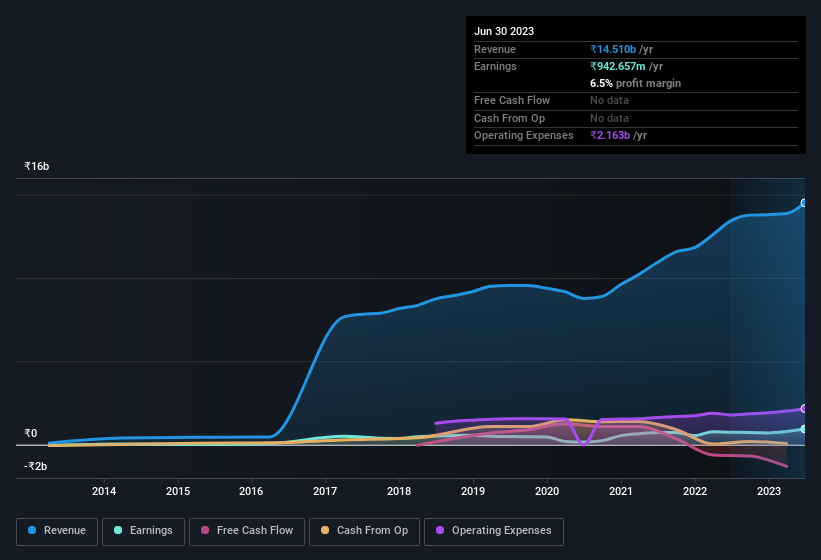

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

IFGL Refractories isn't a huge company, given its market capitalisation of ₹18b. That makes it extra important to check on its balance sheet strength.

Are IFGL Refractories Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. IFGL Refractories followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at ₹1.4b. That's a lot of money, and no small incentive to work hard. Those holdings account for over 7.8% of the company; visible skin in the game.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like IFGL Refractories with market caps between ₹8.3b and ₹33b is about ₹18m.

IFGL Refractories offered total compensation worth ₹16m to its CEO in the year to March 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add IFGL Refractories To Your Watchlist?

For growth investors, IFGL Refractories' raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the key takeaway is that IFGL Refractories is worth keeping an eye on. Still, you should learn about the 2 warning signs we've spotted with IFGL Refractories.

Although IFGL Refractories certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IFGLEXPOR

IFGL Refractories

Manufactures, trades in, and sells refractory items and related equipment and accessories used in steel plants in India and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026