- India

- /

- Entertainment

- /

- NSEI:TIPSMUSIC

Uncovering Gallantt Ispat And Two Other Hidden Small Cap Treasures

Reviewed by Simply Wall St

The Indian market has shown robust performance, increasing by 1.1% over the last week and climbing 42% in the past year, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying small-cap stocks like Gallantt Ispat that have strong growth potential and solid fundamentals can offer unique investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | 3.93% | 3.59% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 14.88% | 27.54% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.26% | 8.68% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Gallantt Ispat (NSEI:GALLANTT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gallantt Ispat Limited manufactures iron and steel in India and internationally, with a market cap of ₹87.02 billion.

Operations: Gallantt Ispat Limited generates revenue primarily from the manufacture of iron and steel. The company has a market cap of ₹87.02 billion.

Gallantt Ispat, a notable player in the metals and mining sector, has seen its earnings grow by 115.2% over the past year, far outpacing industry growth of 17.2%. The company's debt to equity ratio increased from 8.1% to 18.8% over five years, yet its net debt to equity remains satisfactory at 16.6%. Recent financials show sales of ₹11.60 billion for Q1 2024 compared to ₹10.37 billion last year, with net income jumping from ₹307 million to ₹1.22 billion

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricants for the automobile and industrial sectors in India with a market cap of ₹65.74 billion.

Operations: Gulf Oil Lubricants India Limited generates revenue primarily from its lubricants segment, amounting to ₹33.83 billion. The company has a market cap of ₹65.74 billion.

Gulf Oil Lubricants India (GULFOILLUB) has shown robust performance with earnings growing by 33% over the past year, outpacing the Chemicals industry. The company's debt to equity ratio improved from 48.3% to 26.7% in five years, and its interest payments are well covered by EBIT at 14.9x. Recent changes include appointing Sandeep Bangia as Head of Strategy and E Mobility, likely boosting growth prospects in emerging sectors like electric mobility.

Tips Industries (NSEI:TIPSINDLTD)

Simply Wall St Value Rating: ★★★★★★

Overview: Tips Industries Limited engages in the acquisition and exploitation of music rights in India and internationally, with a market cap of ₹92.49 billion.

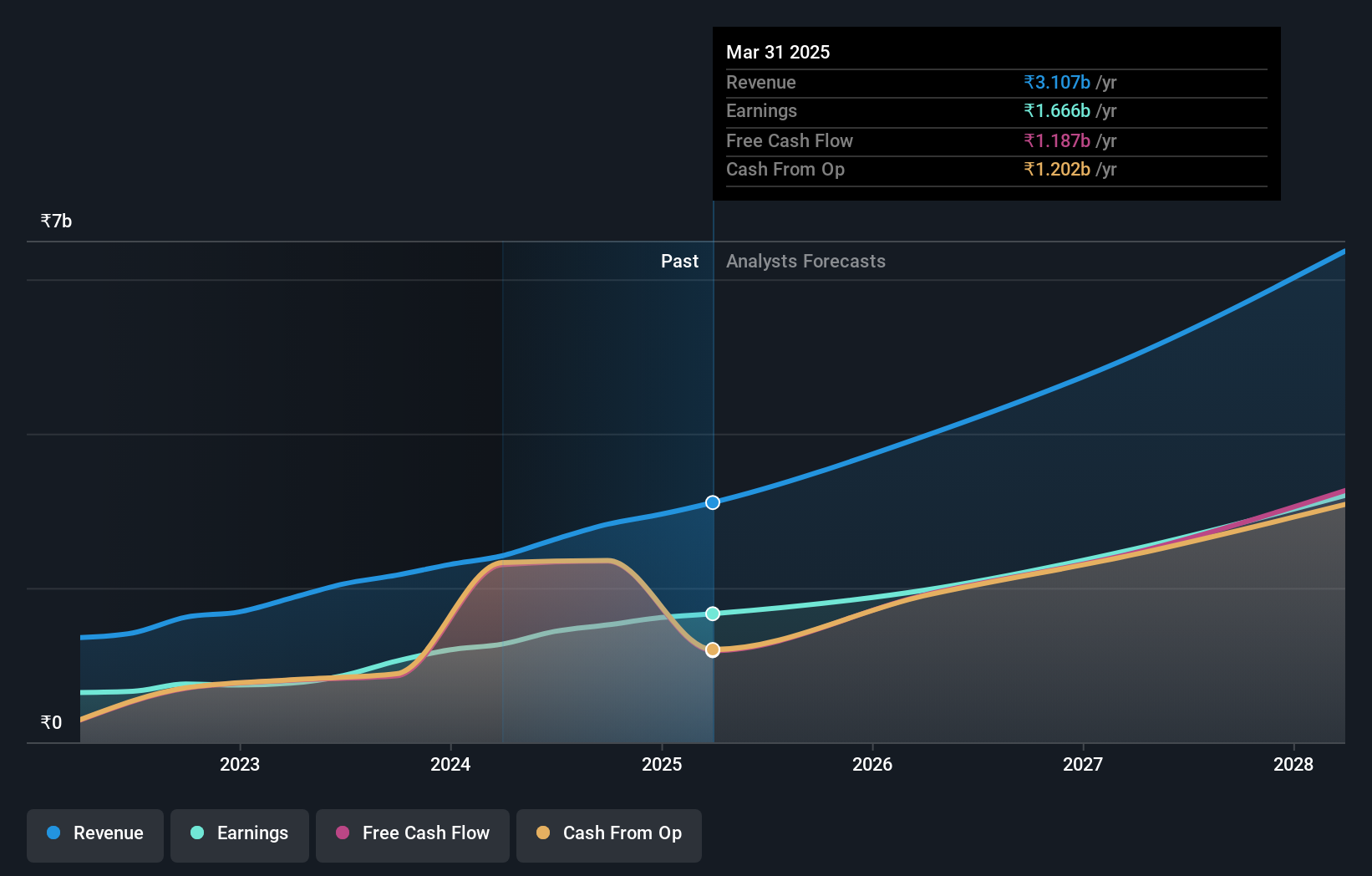

Operations: The primary revenue stream for Tips Industries Limited comes from its music segment, generating ₹2.63 billion.

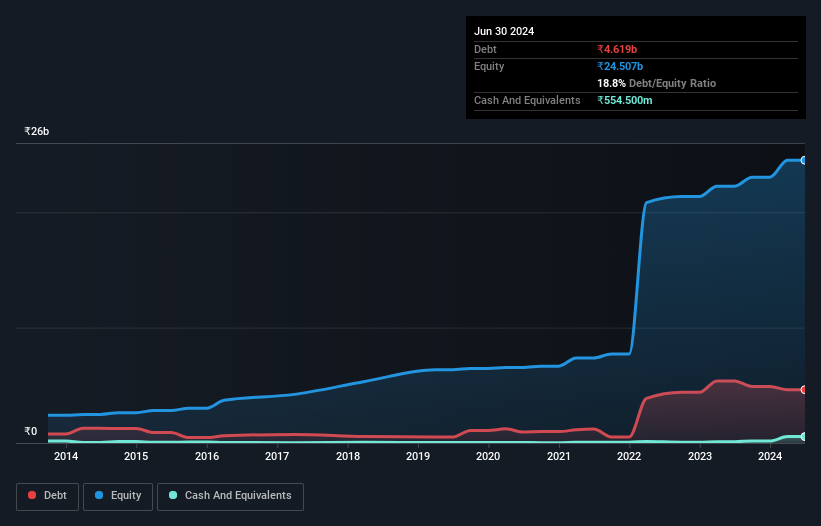

Tips Industries, now rebranded as Tips Music Limited, has shown robust financial health with its debt to equity ratio dropping from 12.1% to 2.8% over the past five years. The company reported a significant earnings growth of 66.2% last year, far outpacing the Entertainment industry’s average growth of 11.6%. For Q1 2024, revenue surged to ₹785 million from ₹546 million a year ago, and net income rose to ₹436 million from ₹271 million previously.

- Get an in-depth perspective on Tips Industries' performance by reading our health report here.

Understand Tips Industries' track record by examining our Past report.

Where To Now?

- Access the full spectrum of 448 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tips Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TIPSMUSIC

Tips Music

Engages in the acquisition and exploitation of music rights in India and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.