Why Investors Shouldn't Be Surprised By Gujarat State Fertilizers & Chemicals Limited's (NSE:GSFC) 27% Share Price Plunge

The Gujarat State Fertilizers & Chemicals Limited (NSE:GSFC) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 77%, which is great even in a bull market.

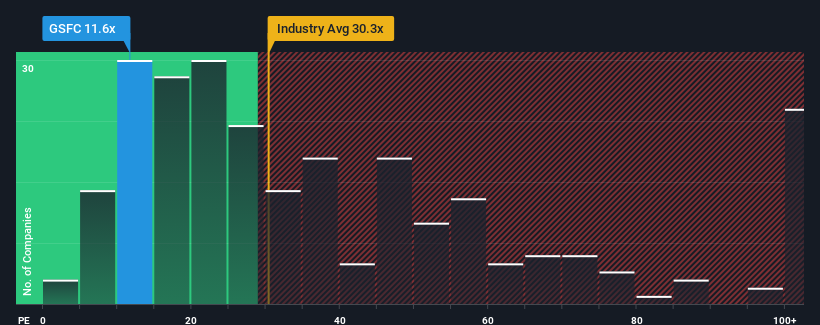

Following the heavy fall in price, Gujarat State Fertilizers & Chemicals' price-to-earnings (or "P/E") ratio of 11.6x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 60x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Gujarat State Fertilizers & Chemicals could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Gujarat State Fertilizers & Chemicals

Is There Any Growth For Gujarat State Fertilizers & Chemicals?

In order to justify its P/E ratio, Gujarat State Fertilizers & Chemicals would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 42%. Even so, admirably EPS has lifted 111% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 3.1% over the next year. That's not great when the rest of the market is expected to grow by 24%.

In light of this, it's understandable that Gujarat State Fertilizers & Chemicals' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Having almost fallen off a cliff, Gujarat State Fertilizers & Chemicals' share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Gujarat State Fertilizers & Chemicals' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Gujarat State Fertilizers & Chemicals that you should be aware of.

If you're unsure about the strength of Gujarat State Fertilizers & Chemicals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GSFC

Gujarat State Fertilizers & Chemicals

Manufactures and sells fertilizers and chemicals in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives