- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPANEL

Greenpanel Industries' (NSE:GREENPANEL) three-year earnings growth trails the incredible shareholder returns

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Greenpanel Industries Limited (NSE:GREENPANEL), which is 978% higher than three years ago. In more good news, the share price has risen 16% in thirty days. We love happy stories like this one. The company should be really proud of that performance!

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Greenpanel Industries

SWOT Analysis for Greenpanel Industries

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Earnings growth over the past year underperformed the Forestry industry.

- Dividend is low compared to the top 25% of dividend payers in the Forestry market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow for the next 4 years.

- Annual earnings are forecast to grow slower than the Indian market.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

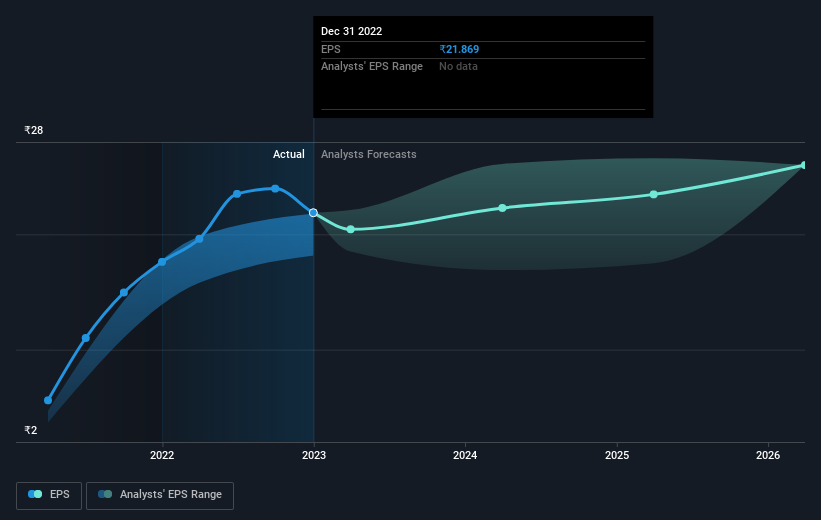

During three years of share price growth, Greenpanel Industries achieved compound earnings per share growth of 151% per year. This EPS growth is higher than the 121% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Greenpanel Industries has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Greenpanel Industries stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Greenpanel Industries' TSR for the last 3 years was 987%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Greenpanel Industries shareholders are down 46% for the year (even including dividends), falling short of the market return. The market shed around 0.6%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 121% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Greenpanel Industries better, we need to consider many other factors. For instance, we've identified 2 warning signs for Greenpanel Industries that you should be aware of.

We will like Greenpanel Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade Greenpanel Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPANEL

Greenpanel Industries

Engages in the manufacturing, marketing, and sale of plywood, medium density fibre board (MDF), and allied products in India and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives