- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPANEL

Do Greenpanel Industries's (NSE:GREENPANEL) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Greenpanel Industries (NSE:GREENPANEL), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Greenpanel Industries

Greenpanel Industries's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Greenpanel Industries has managed to grow EPS by 36% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Greenpanel Industries shareholders can take confidence from the fact that EBIT margins are up from 8.4% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

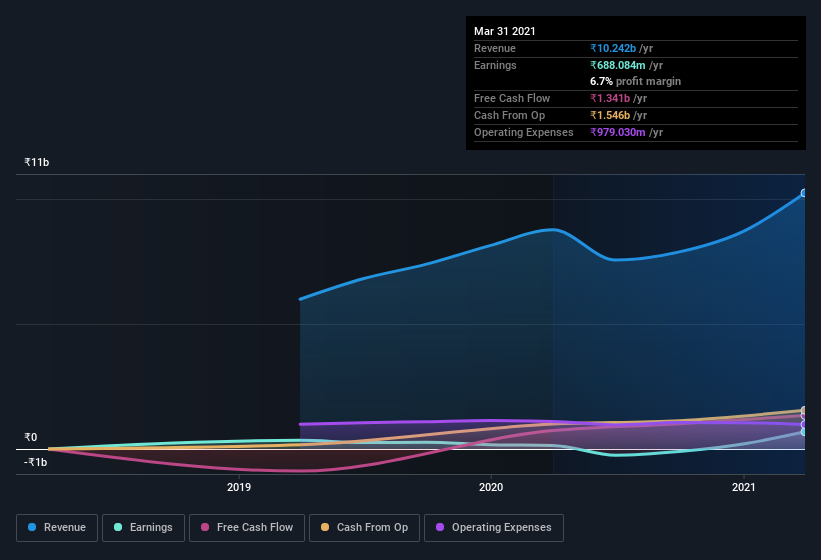

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Greenpanel Industries.

Are Greenpanel Industries Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Greenpanel Industries insiders spent ₹7.0m more buying shares than they received from selling them. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Janaki Venkatramani for ₹2.7m worth of shares, at about ₹177 per share.

Along with the insider buying, another encouraging sign for Greenpanel Industries is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at ₹5.4b, they have plenty of motivation to push the business to succeed. That holding amounts to 18% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Shobhan Mittal is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Greenpanel Industries with market caps between ₹15b and ₹58b is about ₹25m.

The Greenpanel Industries CEO received total compensation of just ₹7.7m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Greenpanel Industries Deserve A Spot On Your Watchlist?

For growth investors like me, Greenpanel Industries's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. Still, you should learn about the 2 warning signs we've spotted with Greenpanel Industries .

The good news is that Greenpanel Industries is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Greenpanel Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GREENPANEL

Greenpanel Industries

Engages in the manufacturing and sale of plywood, medium density fibre board (MDF), and allied products under the Greenpanel brand name in India and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success