- India

- /

- Metals and Mining

- /

- NSEI:GOODLUCK

Is Now The Time To Put Goodluck India (NSE:GOODLUCK) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Goodluck India (NSE:GOODLUCK). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Goodluck India

How Fast Is Goodluck India Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Goodluck India has grown EPS by 31% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

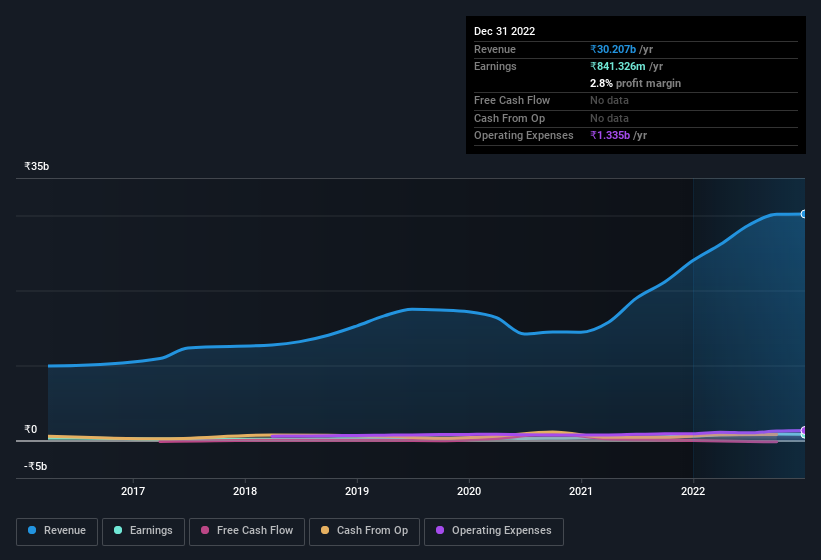

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Goodluck India remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 26% to ₹30b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Goodluck India isn't a huge company, given its market capitalisation of ₹13b. That makes it extra important to check on its balance sheet strength.

Are Goodluck India Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Goodluck India insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹7.6b at the current share price. So there's plenty there to keep them focused!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Goodluck India, with market caps between ₹8.2b and ₹33b, is around ₹18m.

The CEO of Goodluck India only received ₹6.0m in total compensation for the year ending March 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Goodluck India Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Goodluck India's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that Goodluck India has underlying strengths that make it worth a look at. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Goodluck India (1 shouldn't be ignored) you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOODLUCK

Goodluck India

Manufactures and supplies precision engineering and steel products in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives