- India

- /

- Metals and Mining

- /

- NSEI:GOODLUCK

Here's Why I Think Goodluck India (NSE:GOODLUCK) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Goodluck India (NSE:GOODLUCK). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Goodluck India

How Quickly Is Goodluck India Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Goodluck India's EPS has grown 28% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

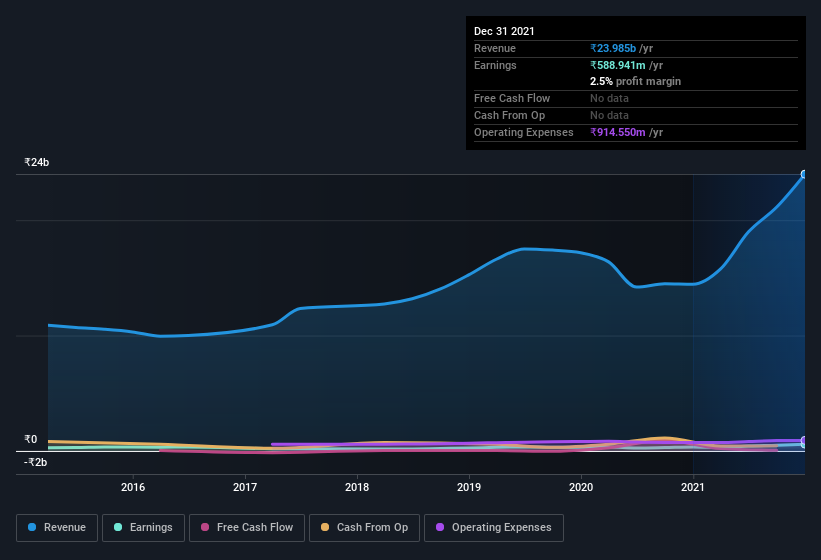

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Goodluck India maintained stable EBIT margins over the last year, all while growing revenue 66% to ₹24b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Goodluck India isn't a huge company, given its market capitalization of ₹8.8b. That makes it extra important to check on its balance sheet strength.

Are Goodluck India Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Goodluck India, is that company insiders paid ₹2.8m for shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. Zooming in, we can see that the biggest insider purchase was by Rekha Rani for ₹961k worth of shares, at about ₹64.80 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Goodluck India insiders own more than a third of the company. In fact, they own 63% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹5.5b invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Goodluck India Deserve A Spot On Your Watchlist?

For growth investors like me, Goodluck India's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Goodluck India (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

The good news is that Goodluck India is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOODLUCK

Goodluck India

Manufactures and supplies precision engineering and steel products in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives