- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

E.I.D.- Parry (India) And 2 Other Undiscovered Gems To Consider In India

Reviewed by Simply Wall St

The Indian market has remained flat over the past week but has impressively risen by 45% over the last year, with earnings projected to grow by 17% annually. In such a dynamic environment, identifying stocks that are not only resilient but also poised for growth can be key to uncovering potential opportunities, making E.I.D.- Parry (India) and two other lesser-known companies worth considering.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

E.I.D.- Parry (India) (NSEI:EIDPARRY)

Simply Wall St Value Rating: ★★★★★★

Overview: E.I.D.- Parry (India) Limited, with a market cap of ₹154.13 billion, operates in the manufacture and sale of sugar, nutraceuticals, and distillery products across India and international markets including North America and Europe.

Operations: E.I.D.- Parry (India) generates revenue primarily from its Nutrient and Allied Business, contributing ₹187.88 billion, followed by Crop Protection at ₹24.61 billion. The Distillery segment adds ₹8.54 billion, while Nutraceuticals contribute ₹2.34 billion to the overall revenue structure.

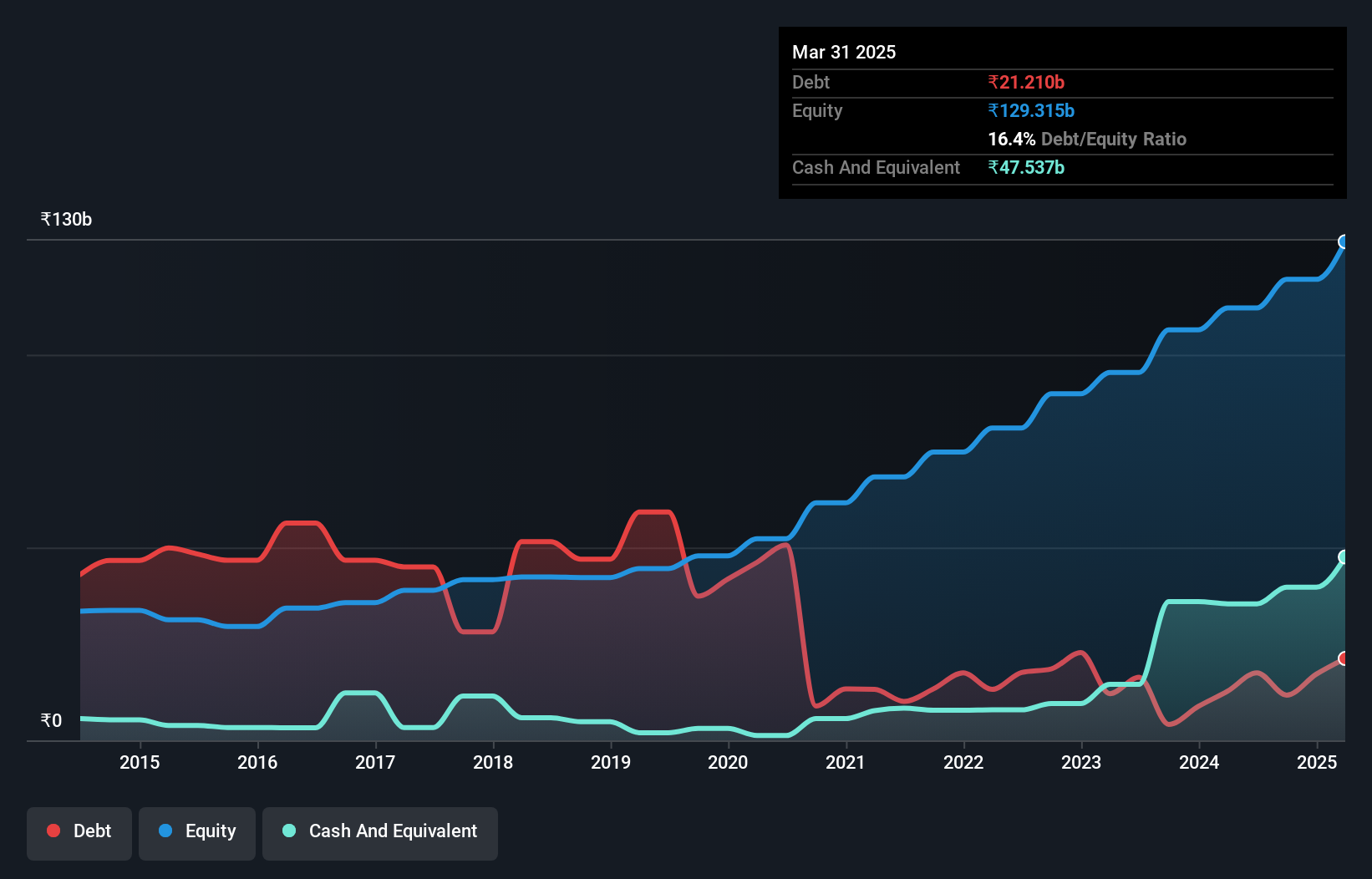

E.I.D.- Parry, a notable player in the Indian market, showcases impressive financial health with interest payments well covered by EBIT at 31.1 times. Over the past five years, its debt-to-equity ratio has significantly improved from 132.9% to 15.6%. Recent earnings growth of 13.1% outpaced the chemicals industry average of 10.7%, although future earnings are expected to decline by an average of 43.7% annually over three years, suggesting potential challenges ahead despite its current value proposition with a P/E ratio of 17.5x against the market's 34.3x.

- Navigate through the intricacies of E.I.D.- Parry (India) with our comprehensive health report here.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both in India and internationally, with a market capitalization of ₹131.24 billion.

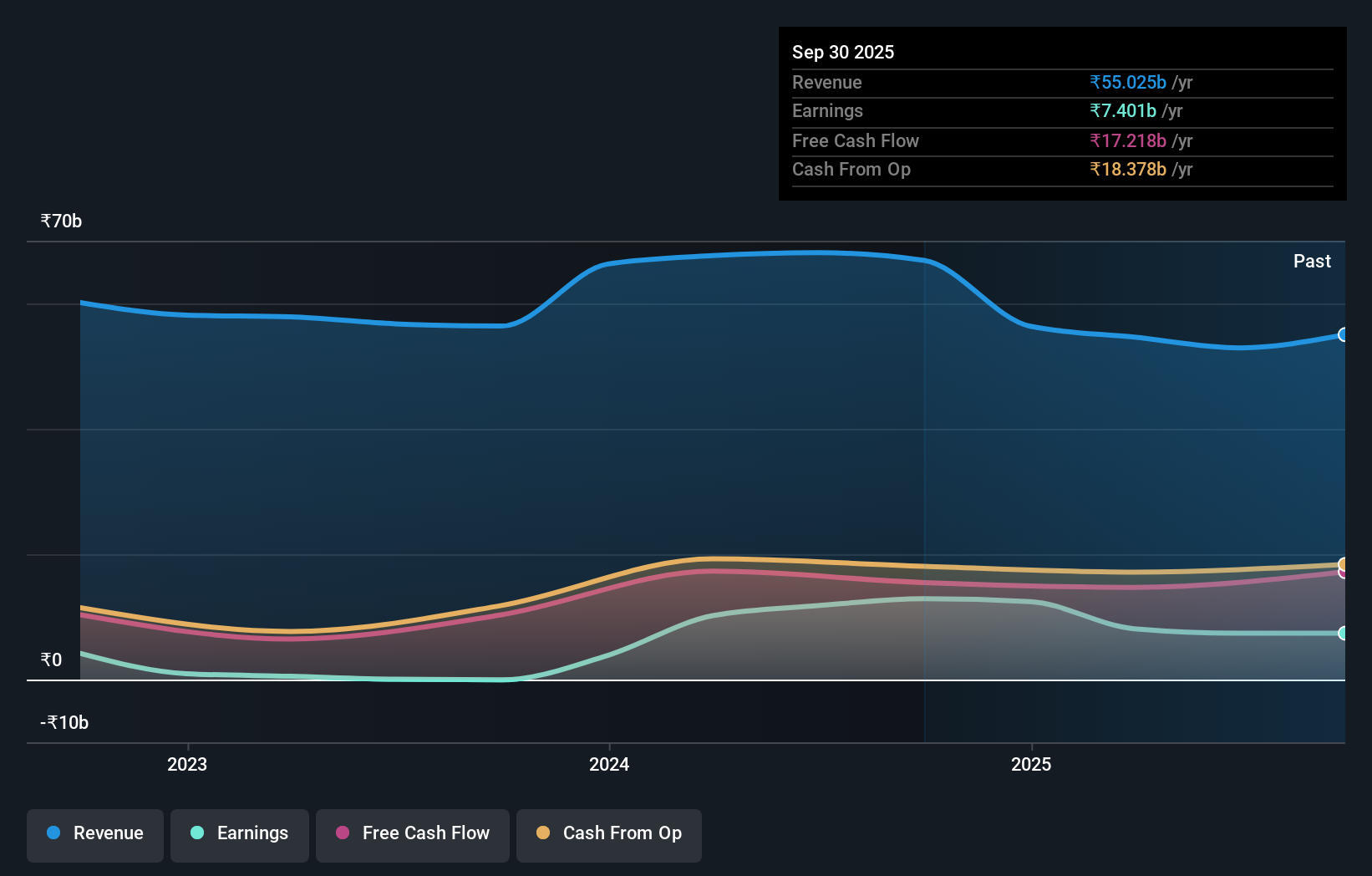

Operations: The company's primary revenue streams are derived from its power generation segment, contributing ₹61.68 billion, and coal segment at ₹6.59 billion. The net profit margin shows a significant trend worth noting.

Jaiprakash Power Ventures, a notable player in the energy sector, has seen its debt-to-equity ratio significantly drop from 254.1% to 37% over five years, indicating improved financial health. Despite a one-off loss of ₹6.9 billion impacting recent results, the company reported impressive earnings growth of 22,969%, outpacing industry averages. Trading at 68.4% below estimated fair value suggests potential undervaluation for investors eyeing opportunities in India's renewable energy landscape.

- Click to explore a detailed breakdown of our findings in Jaiprakash Power Ventures' health report.

Understand Jaiprakash Power Ventures' track record by examining our Past report.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited is involved in the generation of solar power in India and has a market capitalization of ₹69.46 billion.

Operations: Ujaas Energy Limited primarily generates revenue from its Solar Power Plant Operation, contributing ₹307.70 million. The company's Electric Vehicle (EV) segment adds ₹41 million to the revenue stream.

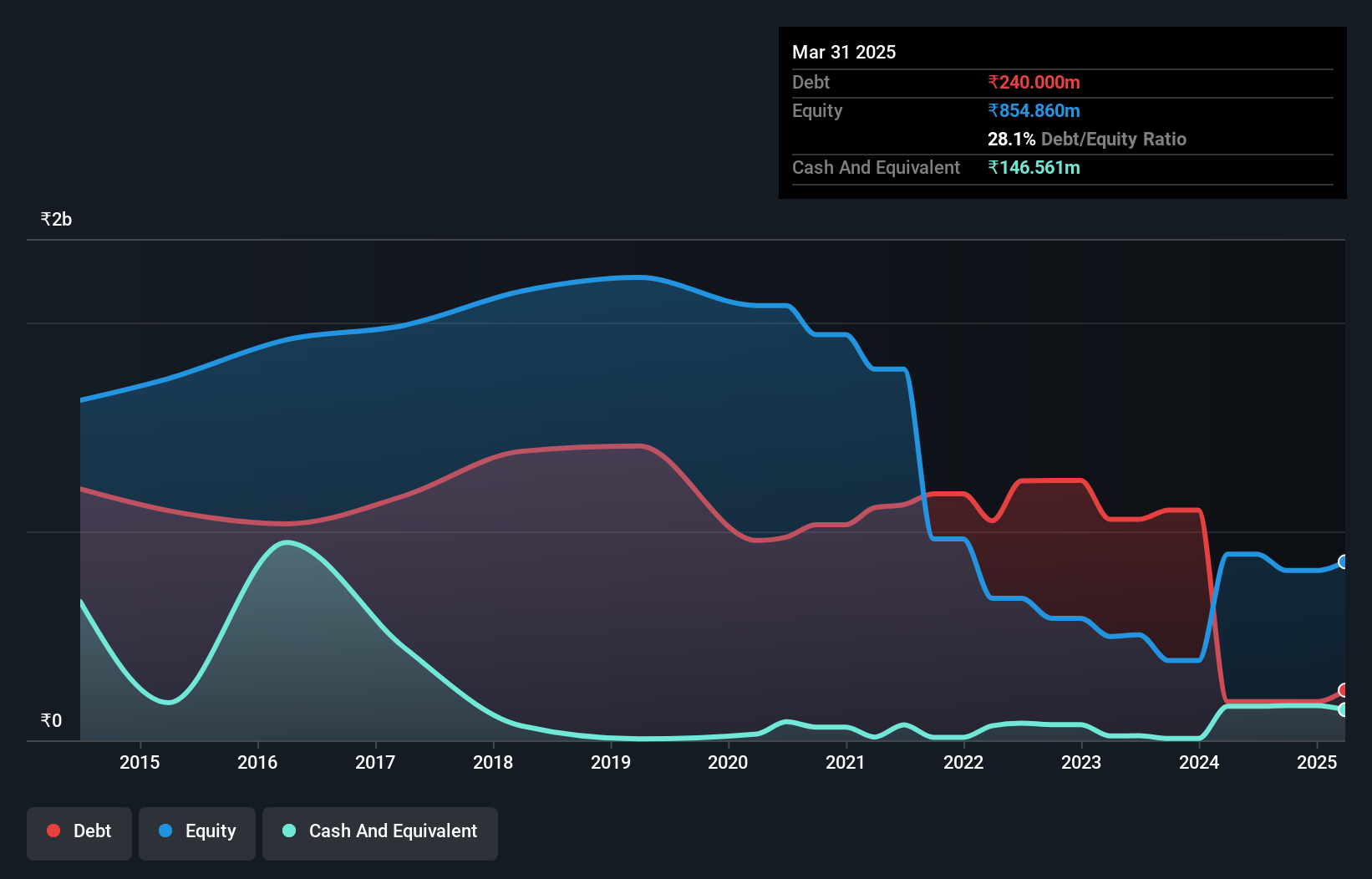

Ujaas Energy, a small player in the energy sector, has seen significant financial shifts recently. The company reported revenue of ₹107.16 million for the first quarter ending June 2024, up from ₹74.83 million a year ago, with net income at ₹38.15 million compared to a loss of ₹58.57 million previously. Its debt-to-equity ratio improved dramatically over five years from 59% to 21%. Despite these gains, shares remain highly illiquid and revenue lacks substantial growth potential at just ₹258M annually.

- Click here to discover the nuances of Ujaas Energy with our detailed analytical health report.

Gain insights into Ujaas Energy's historical performance by reviewing our past performance report.

Summing It All Up

- Explore the 474 names from our Indian Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives