We Discuss Why Deepak Nitrite Limited's (NSE:DEEPAKNTR) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

Key Insights

- Deepak Nitrite's Annual General Meeting to take place on 14th of August

- Total pay for CEO Maulik Mehta includes ₹27.7m salary

- Total compensation is 32% below industry average

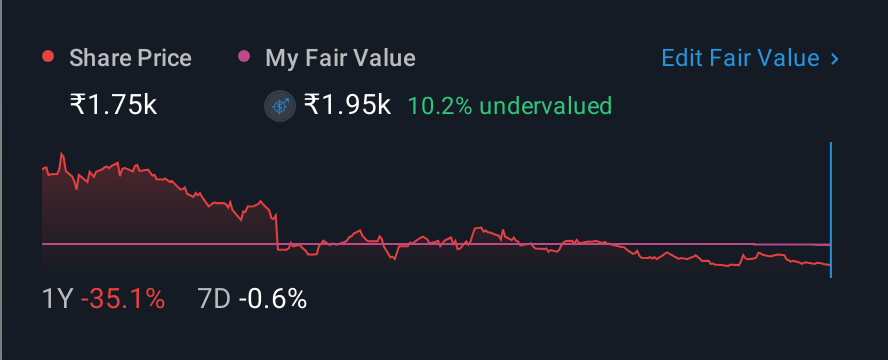

- Deepak Nitrite's EPS declined by 13% over the past three years while total shareholder loss over the past three years was 8.9%

The underwhelming performance at Deepak Nitrite Limited (NSE:DEEPAKNTR) recently has probably not pleased shareholders. The next AGM coming up on 14th of August will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

See our latest analysis for Deepak Nitrite

Comparing Deepak Nitrite Limited's CEO Compensation With The Industry

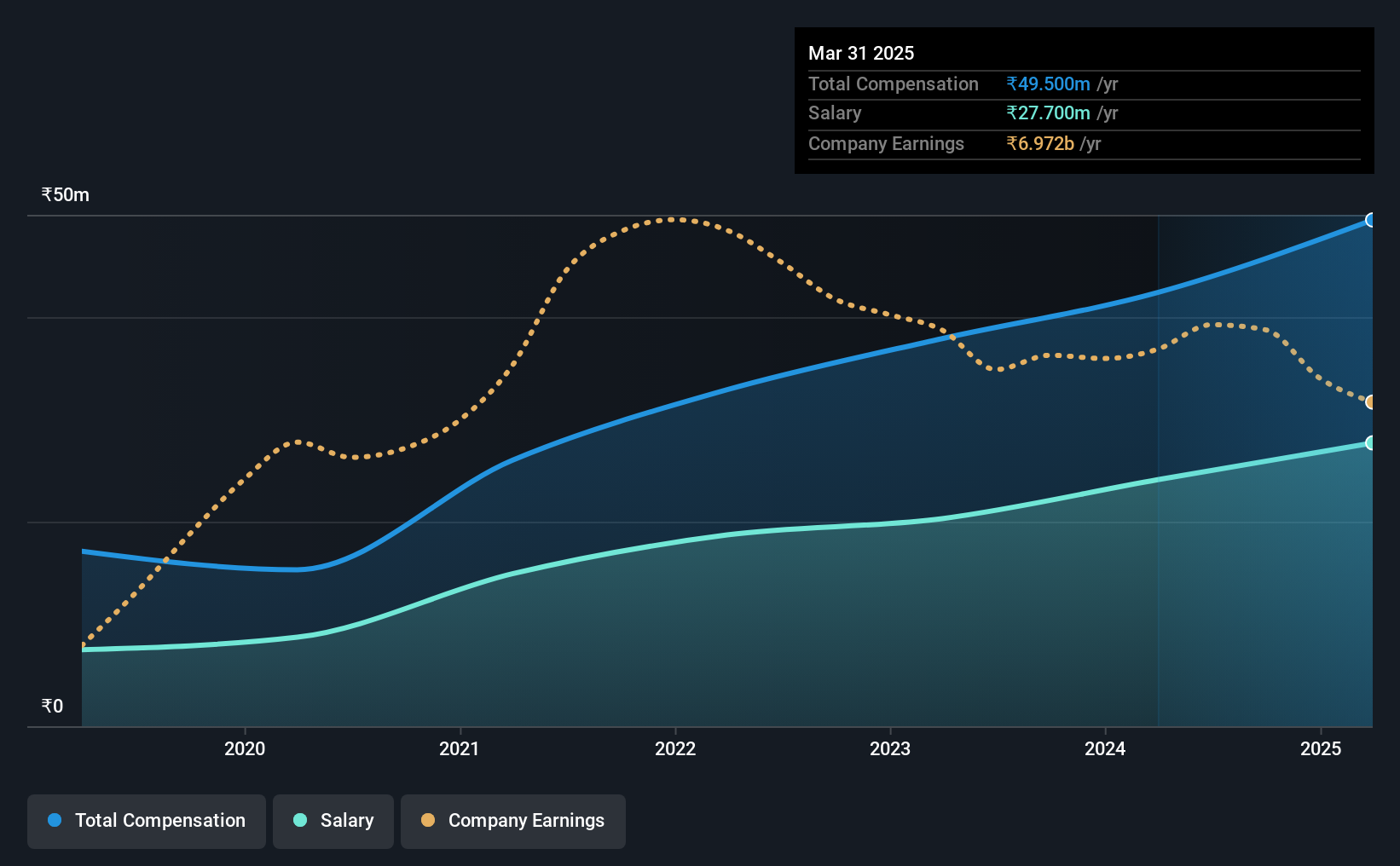

According to our data, Deepak Nitrite Limited has a market capitalization of ₹247b, and paid its CEO total annual compensation worth ₹50m over the year to March 2025. That's a notable increase of 17% on last year. We note that the salary of ₹27.7m makes up a sizeable portion of the total compensation received by the CEO.

On examining similar-sized companies in the Indian Chemicals industry with market capitalizations between ₹175b and ₹560b, we discovered that the median CEO total compensation of that group was ₹73m. That is to say, Maulik Mehta is paid under the industry median. What's more, Maulik Mehta holds ₹240m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹28m | ₹24m | 56% |

| Other | ₹22m | ₹18m | 44% |

| Total Compensation | ₹50m | ₹42m | 100% |

On an industry level, around 85% of total compensation represents salary and 15% is other remuneration. Deepak Nitrite sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Deepak Nitrite Limited's Growth

Deepak Nitrite Limited has reduced its earnings per share by 13% a year over the last three years. It achieved revenue growth of 7.8% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Deepak Nitrite Limited Been A Good Investment?

Since shareholders would have lost about 8.9% over three years, some Deepak Nitrite Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is a bit unpleasant) in Deepak Nitrite we think you should know about.

Switching gears from Deepak Nitrite, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEEPAKNTR

Deepak Nitrite

Manufactures, trades and sells chemical intermediates in India and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026