- India

- /

- Metals and Mining

- /

- NSEI:CUBEXTUB

After Leaping 25% Cubex Tubings Limited (NSE:CUBEXTUB) Shares Are Not Flying Under The Radar

Cubex Tubings Limited (NSE:CUBEXTUB) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 173% in the last year.

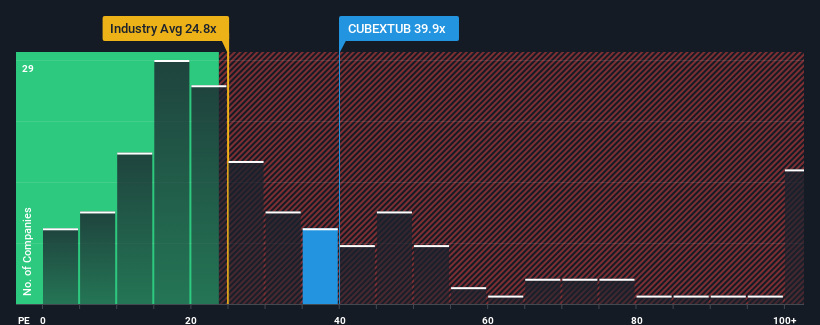

After such a large jump in price, Cubex Tubings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 39.9x, since almost half of all companies in India have P/E ratios under 33x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for Cubex Tubings as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Cubex Tubings

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Cubex Tubings would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. The strong recent performance means it was also able to grow EPS by 200% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Cubex Tubings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Cubex Tubings' P/E?

Cubex Tubings' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Cubex Tubings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Cubex Tubings that you should be aware of.

If these risks are making you reconsider your opinion on Cubex Tubings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CUBEXTUB

Cubex Tubings

Manufactures and sells copper and copper based alloy products in India and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives