Clariant Chemicals (India)'s (NSE:CLNINDIA) Earnings Are Growing But Is There More To The Story?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Clariant Chemicals (India)'s (NSE:CLNINDIA) statutory profits are a good guide to its underlying earnings.

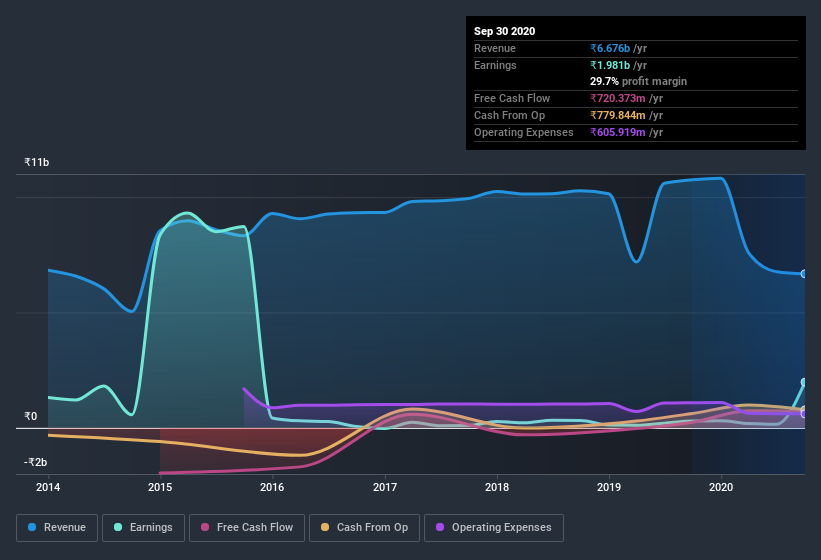

While Clariant Chemicals (India) was able to generate revenue of ₹6.68b in the last twelve months, we think its profit result of ₹1.98b was more important. The chart below shows how profit has actually increased over the last three years, even while revenue has declined.

View our latest analysis for Clariant Chemicals (India)

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, today we're going to take a closer look at Clariant Chemicals (India)'s cashflow, and unusual items, with a view to understanding what these might tell us about its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Clariant Chemicals (India).

Examining Cashflow Against Clariant Chemicals (India)'s Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to September 2020, Clariant Chemicals (India) had an accrual ratio of 0.27. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In fact, it had free cash flow of ₹720m in the last year, which was a lot less than its statutory profit of ₹1.98b. We note, however, that Clariant Chemicals (India) grew its free cash flow over the last year. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by ₹2.6b, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Clariant Chemicals (India) had a rather significant contribution from unusual items relative to its profit to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Clariant Chemicals (India)'s Profit Performance

Summing up, Clariant Chemicals (India) received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Clariant Chemicals (India)'s profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, Clariant Chemicals (India) has 3 warning signs (and 2 which are concerning) we think you should know about.

Our examination of Clariant Chemicals (India) has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Clariant Chemicals (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heubach Colorants India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HEUBACHIND

Heubach Colorants India

Engages in the manufacture and sale of specialty chemicals in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives